Pramod Kulkarni, World Oil

With the industry facing low crude oil prices for the foreseeable future, the Middle East and North Africa (MENA) region remains an oasis of increasing oilfield activity, due to minimal lifting costs.

Saudi Aramco has budgeted $50 billion to double crude oil and liquids production from Shaybah field (left). Rowan Company’s Bob Palmer jackup rig drilling an offshore prospect for Saudi Aramco (center). Abu Dhabi’s TAQA rig making hole in Atrush field of Kurdistan.

Low oil prices have resulted in reduced revenues for oil producers throughout the world, including those in MENA region. Even Saudi Arabia, which triggered the decline in prices with its decision to increase production as a means of retaining the country’s market share, has been forced to begin borrowing from capital markets, to the tune of $4 billion in July, 2015, with plans to raise a total of $27 billion for the time being. International Monetary Fund (IMF) estimates that $50/bbl oil will lead to a deficit of $140 billion for the Kingdom. Nevertheless, Saudi Arabia plans to keep its oil spigot fully open to continue to produce above 9.5 MMbpd, and expects its fellow OPEC member nations to follow in its footsteps.

While oil and gas activity is contracting in the rest of the world, the MENA region will remain an oasis of active E&P projects to sustain record production levels. With lifting costs as low as $15/bbl, the region will have the economic incentive to keep production in overdrive. However, according to Rystad Energy, Saudi Arabia has spare production capacity of only 1.1 MMbopd. To increase spare capacity through organic growth, the MENA region in general, and Saudi Arabia in particular, will need advanced oilfield technology to increase reserves and production. As a result, Western oilfield technology providers—service companies and equipment manufacturers—will continue to see a high demand for their products and services.

SAUDI ARABIA

Saudi Arabia has the largest share of the world’s oil reserves (16%), estimated by state firm Saudi Aramco at 261.1 Bbbl. In addition, the Kingdom owns half of the oil reserves (2.5 Bbbl) in the Neutral Zone that it shares with Kuwait. According to World Oil figures, Saudi Arabia increased its oil reserves by 0.3% in 2014. Average oil production in 2015 was 9.5 MMbpd, up 5.3% from 2013. Saudi Arabia’s natural gas reserves are the fifth largest in the world, at 294 Tcf, up 1.9% from the previous year. The country processed 11.3 Bcfgd, up nearly 3% from 2013.

To maintain crude oil production at record levels, Saudi Arabia, through Saudi Aramco, needs to extract more production from brownfields and develop greenfields. As part of this effort, Saudi Aramco has signed major, long-term contracts with McDermott and Wood Group Mustang for engineering, procurement and construction work at its

offshore fields.

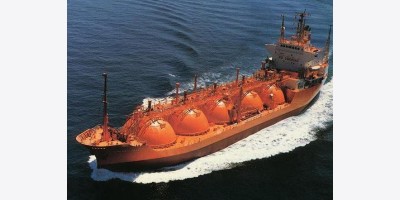

One of Saudi Aramco’s mega projects is the expansion of Shaybah field in the Empty Quarter to increase oil production capacity and NGLs at an estimated cost of $50 billion, Fig. 1. The expansion will lead to a production capacity of 1 MMbpd by April 2016, double its initial capacity in 1998. The expansion is being accomplished by designing wells to increase the average reservoir contact to 10 km.

Saudi Aramco also is experimenting with enhanced oil recovery through CO2 injection. A demonstration project is underway in the mature Uthmaniyah field. In 2014, a SmartWater Flood demonstration project at North Uthmaniyah resulted in a successful formation evaluation at the first observation well of the field pilot. The front-end engineering and design of cable-deployed ESPs was completed, with field prototype design, manufacturing, and testing slated for 2015. These pumps will be used to boost production rates in offshore fields, such as Safaniya.

In early 2015, Saudi Aramco was running 212 drilling rigs. The company discovered eight new fields in 2014, the largest annual total in its history. The total includes five gas fields, Abu Ali, Faras, Amjad, Badi and Faris; two oil fields, Sadawi and Naqa; and one oil and gas field, Qadqad. This brings the number of discovered fields to 129. The company completed a number of offshore wells in the Red Sea, providing a deeper understanding of the complex geology. Overall, well completions were up 8.3% last year, at 511 wells. Given Saudi Aramco’s extensive upstream backlog, a 20.5% increase to 616 wells is forecast during 2015.

IRAN

Iran is the wildcard in the Middle East’s oil production scenario. If the sanctions are lifted, Iran is expected to make every effort to restore output to the level that it had achieved before the economic curbs crippled production and exports. According to Oil Minister Bijan Namdar Zanganeh, “Iran wants to pump almost 4 MMbopd within seven months, once sanctions are removed and 4.7 MMbopd, as soon as possible.” The minister’s desire may be a pipedream, as Bloomberg’s production data suggest that Iran’s production slid to 2.66 MMbopd by the end of 2012 after sanctions were tightened in July of that year. The country now pumps 2.8 MMbopd, down from more than 4 MMbopd a decade ago and a peak of 6 MMbopd in 1974. EIA reports that Iranian oil exports declined to 1.4 MMbpd, on average, during 2014. Iran also plans to increase gas exports seven-fold to 200 MMcmd in four years.

It may take years and considerable investment (as much as $200 billion) to restore Iran’s aging oil and gas fields for production to deliver 4 MMbopd and 200 MMcmd. The International Energy Agency (IEA) has said that Iran’s largest fields, including Gachsaran and Marun, in production for more than 50 years, are in “sore need” of rehabilitation. The Iranian government expects at least half of the investment to come from international oil companies. “We welcome and appreciate investment by companies; we welcome new technology,” Azizollah Ramazani, International Affairs Director at National Iranian Gas Co., said in an interview in Paris. “During the last 18 months, we have had many discussions with foreign companies.”

Oil producers, such as BP and Royal Dutch Shell, have expressed interest in developing Iran’s reserves, the world’s fourth-biggest, once sanctions are removed. Iran is organizing a conference in London in December to discuss new oil contract models with international companies.

IRAQ

Debilitated by decades of war, Iraq’s oil production, from both southern and northern fields, is climbing at a rapid rate. The production rate reached a record 3.3 MMbopd in 2015. The disquieting element in this rosy outlook is the capture of several oil fields by the Islamic State of Iraq and Syria (ISIS). In March 2015, Iraqi forces entered the central city of Tikrit, in an attempt to drive out Islamic State militants, and regained control of two oil fields in the region. Of the recaptured fields, Ajeel has a production capacity of 28,000 bopd, even though airstrikes by the U.S.-led coalition have caused significant damage.

In September 2015, Iraq asked its oil companies to reduce their 2016 E&P spending plans, citing lower oil prices and limited government revenues. As a result, international oil companies, such as Exxon Mobil, BP and Royal Dutch Shell, have reduced production targets at several of the country’s biggest oil fields, including Rumaila, West Qurna-1 and Majnoon.

Besides ISIS, Iraq’s government has another headache in the form of self-ruled Kurds, who control production from the northern fields around Kirkuk. The Kurds are bypassing the government in Baghdad to independently sell their crude oil, as much as 600,000 bpd. However, a U.S. court rejected a Kurdish attempt to deliver crude oil to a Gulf Coast port.

Of recent successes, Gazprom Neft brought its fourth well into production at Iraq’s Badra field. This new, high-flow-rate well (Р-05) has allowed total production at the field to nearly double, to 27,000 bopd. Field development is continuing, with the P-04 well being brought online at an expected flowrate of 10,000 bopd. Meanwhile, Lukoil is producing from West Qurna-2 field at a rate of 120,000 bopd. Lukoil plans to lift production at the site to a plateau of 1.2 MMbbl by end-2017, after drilling 459 wells and using water injection. West Qurna-1, operated by Exxon Mobil, and Eni-operated Zubair oil field will also contribute to increasing Iraq’s growing output.

BP and partner CNPC are developing the 17-Bbbl Rumaila field. Iraq’s largest, Rumaila is pumping around 1.4 MMbopd and it is expected to hit 2.1 MMbopd in 2017. Meanwhile, PetroChina has begun construction of the second phase of its Halfaya oilfield project. This phase includes the drilling of 60 additional wells and a processing center capable of handling 100,000 bpd.

KUWAIT

As of January 2014, Kuwait held crude oil reserves of 102.2 Bbbl, sixth in the world. In addition, Kuwait owns 2.5 Bbbl of crude oil from the Neutral Zone that the country shares with Saudi Arabia. In 2013, Kuwait’s petroleum and other liquids production was approximately 2.6 MMbpd, including its share of approximately 250,000 bpd of oil production from the Neutral Zone.

In January 2014, Kuwait had an estimated 63.1 Tcf of natural gas reserves. In 2013, Kuwait produced 1.5 Bcfgd or 552 Bcf per year. Due to rising domestic demand, Kuwait has actually become a net importer of natural gas.

Before the oil-price decline in 2014, Kuwait Petroleum had announced a $40-billion capital spending plan over five years (2015-20) for the upstream sector. The goal is to boost total oil production capacity to 4.0 MMbpd by 2020, and maintain that level through 2030. In 2014, wells drilled were up 6.7%. A further, 4.4% increase is forecast for 2015. Oil production was up 2.1%, at 2.615 MMbpd.

The Kuwaiti constitution prohibits production-sharing agreements that allow for an equity stake by IOCs. Instead, Kuwait is using technical service agreements (TSAs) to bring in IOCs to develop more difficult projects. Earlier in 2015, Petrofac received a major contract for the first phase of Kuwait’s Lower Fars heavy oil development program. With a total project value of more than $4 billion, the scope of work covers both greenfield and brownfield facilities. When fully operational, it is expected that the initial phase of the Lower Fars heavy oil project will produce around 60,000 bpd.

NEUTRAL ZONE

After years of cooperation, the partitioned Neutral Zone has become a source of contention between Kuwait and Saudi Arabia. The problems arose when Saudi Arabia renewed Chevron’s 30-year concession to operate Wafra field without first consulting Kuwaiti authorities. As a result, as much as 300,000 bopd of production has been mothballed, while attempts are made to resolve the conflict.

UAE

United Arab Emirates (UAE) is the sixth-largest petroleum producer in the world, behind only Saudi Arabia in OPEC. The country’s reserves of 97.8 Bbbl are mostly located in Abu Dhabi. The UAE produced 3.5 MMbpd of petroleum and other liquids in 2014, of which 2.7 MMbpd was crude oil. Due to the fact that most of the associated natural gas is reinjected to boost oil production, UAE is a net gas importer. The country has plans to develop some non-associated sour gas fields to overcome this deficiency.

Without any recent, significant oil discoveries, officials have concentrated on getting the most recovery out of the resources that they do have. One item that may help Abu Dhabi boost oil output is the Zakum area. Operator ZADCO—owned jointly by ADNOC, Exxon Mobil and the Japan Oil Development Company—manages production from Upper Zakum field, where output is about 590,000 bopd.

Three years ago, ZADCO awarded an $800-million contract to expand Upper Zakum’s oil production to 750,000 bpd by 2016. Production from Lower Zakum field—operated by Abu Dhabi Marine Operating Company (ADMA-OPCO)—is also set to increase. Production eventually should reach 425,000 bopd, up from the current 345,000-bopd level. Across the emirate, oil production was up 0.5%. Drilling totaled 146 wells, up 17.7%. With work at Upper and Lower Zakum ongoing, drilling will gain another 13% this year, totaling 165 wells.

QATAR

Unlike most of its neighbors, Qatar has limited oil reserves (25 MMbbl), but it is a juggernaut in natural gas reserves (872.5 Tcf). While Qatar is the world’s fourth-largest dry natural gas producer, it has been the world’s leading exporter of LNG since 2006. According to the EIA, Qatar’s last major discovery was Al Rayyan field in 1994. Supply growth is being sought from existing fields through EOR techniques. Operators have used EOR injection in several fields, including Al-Shaheen, Dukhan, BuHanine and Maydan Marjam.

In March 2015, Qatar Petroleum awarded McDermott International a large project for the North Field Alpha gas development, offshore Qatar. Work is expected to be executed through the second quarter of 2016. The brownfield contract includes front-end engineering design verification, detailed engineering, procurement, construction, installation (EPCI), and commissioning of a new six-legged, 15-slot wellhead jacket and temporary drill deck.

OMAN

The largest Middle East oil and gas producer that is not a member of OPEC, the Sultanate of Oman has estimated proved oil reserves of 5.1 Bbbl, placing it seventh in the Middle East and 23rd in the world, as of January 2015. Oil production was 948,000 bpd in 2015, an increase of 0.4% over 2014. Daily crude output was 847,000 bpd and condensate accounted for 101,000 bpd.

On the natural gas side, Oman is considering importing LNG to meet rising domestic demand, despite the fact that the country exports LNG on long-term contracts to Spain, Japan and South Korea. LNG imports will supplement Oman’s natural gas supply by pipeline from Qatar. Oman is also hoping to import gas via a separate pipeline from Iran.

To increase domestic production, Oman has invited bids for five blocks in its upcoming licensing round. These consist of two offshore blocks—18 and 59—and three onshore blocks—43A, 54 and 58. Block 18—at a water depth ranging from 30 m to 3,000 m, is in the north Sohar basin and covers 21,140 km2. Block 59, which lies off the east coast of central Oman, covers an area of 40,488 km2. Onshore, Block 54, which covers 5,632 km2, is near state operator Petroleum Development Oman’s Block 6 oil fields, Oxy’s Block 53 Mukhaizna field, and Blocks 3 and 4. Block 43A, which MOG describes as being under-explored, lies in the north of Oman’s mountains and covers 6,879 km2. And Block 58, which covers 2,277 km2, is situated on the southern edge of the Western Flank between the South Oman Salt basin and the Rub al Khali basin.

EGYPT

The major story out of Egypt is Eni’s “super giant” gas discovery in the Mediterranean Sea. The deepwater deposit in the Zohr prospect of the Shorouk Block may hold 30 Tcf of gas, equivalent to 5.5 Bboe. Eni will likely sell most of the fuel into Egypt’s domestic market, said a spokesman. With a minimum development period of at least four years, it would be about 2020 before any production starts in the Shorouk Block.

Fig. 2. In early 2015, the Maersk Discoverer drilled a major discovery for BP at offshore Egypt’s North Damietta Offshore Concession in the East Nile Delta area.

In March 2015, BP signed the final agreements for the West Nile Delta (WND) project, to develop 5 Tcf of gas resources and 55 MMbbl of condensates, with an estimated investment of around $12 billion. Production from WND is expected to reach up to 1.2 Bcfd, equivalent to about 25% of Egypt’s current gas production. All the produced gas will be fed into the country’s national gas grid, helping to meet the anticipated growth in local demand for energy. Production is expected to start in 2017.

BP Egypt also made a gas discovery in the North Damietta Offshore Concession of the East Nile Delta. The Atoll-1 deepwater well reached a 6,400-m depth and penetrated approximately 50 m of gas pay in high-quality Oligocene sandstones. Expected to be the deepest well ever drilled in Egypt, the Atoll well still has another 1 km to drill to test the same reservoir section found to be gas bearing in BP’s 2013 Salamat discovery, 15 km to the south. Atoll-1 was drilled in 923 m of water about 80 km north of Damietta city, Fig. 2.

In a related development, Dana Gas has completed an agreement with BP, whereby BP will carry Dana Gas for the drilling of a first exploration well in the El Matariya Onshore Concession Area, in the Nile Delta, which was awarded to BP and Dana in the EGAS 2014 bidding round. The drilling of the first exploration well is expected to start in first-half 2016 and will take approximately eight months to be completed.

Onshore, Apache has reported strong appraisal-and development-drilling results from Egypt, following the discovery of two new oil fields in the Western Desert. Berenice and Ptah fields are in the Faghur basin, along the same fault trend in the Khalda Offset Concession. Exploration and drilling efforts are targeting rock from both the Mesozoic and deeper Paleozoic eras. These targets are a primary focus for Apache Egypt and have proven successful in this area, with oil and gas discoveries made at the nearby Shu-1X, Apries-1X, Bat-1X and Geb-1X wells, although Ptah is the largest new field found in the play thus far. Apache has three rigs operating in these two fields to drill development wells.

LIBYA

Libya is endowed by 48 Bbbl of oil reserves, the largest in all of Africa. In 2010, Libya’s production had declined to 1.6 MMbopd after a peak of 3 MMbopd in the 1960s, due primarily due to aging fields. The production has risen and fallen since 2010, depending upon the level of hostilities after the ouster of strongman Muammar Gaddafi. In early 2015, the output was less than 600 Mbopd. The war-torn country has natural gas reserves of 55 Tcf, the least of all the African countries. The annual gas production was about 400 Bcf in 2013, representing a slight recovery from a sharp drop to 200 Bcf.

Libya stopped crude exports from the two ports in December after militias attacked Es Sider, its largest oil terminal, forcing the state oil company declared force majeure. In July, BP wrote down $600 million as a result. Earlier, Total had taken a writedown of $755 million for its impaired assets.

Despite the civil strife, there have been a few positive developments. Eni made a gas and condensate discovery offshore Libya, in the Bouri North exploration prospect in Area D, 140 km from the coast and 20 km north of the producing Bouri field. The well is expected to deliver 3,000 boed.

MAURITANIA

Mauritania has seen numerous exploration campaigns in recent decades with mixed results. In April 2015, Kosmos Energy made a play-opening gas discovery at the Tortue-1 exploration well, drilled to test the Tortue West prospect, which forms part of the Greater Tortue Complex, in offshore Block C-8. Based on the preliminary analysis of drilling results and intermediate logging to a depth of 4,630 m, Tortue-1 has intersected 107 m of net hydrocarbon pay. A single gas pool was encountered in the primary Lower Cenomanian objective. The Lower Cenomanian is comprised of three excellent-quality multi-Darcy reservoirs, totaling 88 m in thickness over a gross hydrocarbon-bearing interval of 160 m. A fourth zone, 19 m thick, was penetrated within the secondary Upper Cenomanian target over a gross hydrocarbon-bearing interval of 150 m.

An appraisal program is being planned to delineate the Tortue West discovery. In addition, the Marsouin-1 exploration well, in the central part of Block C-8, is expected to spud in the third quarter of 2015. An exploration program is also being formulated to test the other prospects in the Greater Tortue Complex, which extend into the St. Louis Offshore Profond Block in Senegal. In March 2015, Chevron acquired a 30% non-operated interest in the C-8, C-12 and C-13 contract areas under production sharing contracts. The blocks are contiguous, range in water depths between 1,000 m and 3,000 m, and have combined acreage of approximately 27,000 km2.

Also working offshore Mauritania is a partnership of Chariot Energy and Cain Energy, working in Block C-19. Chariot is the operator with an interest of 55%. Cairn holds 35% and SMHPM holds a 10% carried interest. During 2014, the partnership carried out a significant amount of additional technical work on its 3,500 km2 of proprietary 3D seismic data. From this, Chariot has identified and matured a significant prospect and lead portfolio, which includes four prospects that are now drill-ready.

In 2014, UK-based Tullow Oil hit a major gas discovery in Block C-7. The Fregate-1 well discovered about 30 m of net gas condensate and oil accumulation after drilling to a depth of 5,426 m.

ALGERIA

Algeria has North Africa’s largest natural gas (138.7 Tcf) and limited oil reserves (14.7 Bbbl). Crude and condensate output was up 4.7% in 2014, averaging 1.347 MMbpd. According to the EIA, Algeria’s natural gas production was 6.4 Tcf in 2012, a 4% decline from the previous year. Gross production has been falling since its peak of 7.1 Tcf in 2008. Oil reserves increased 4.3%, and gas reserves improved 2.9% during 2014.

Algerian oil fields produce high-quality, light crude oil. Hassi Messaoud is the largest field, produring more than 40% of Algeria’s total crude output. Other large producing areas in Algeria are Ourhoud and the Hassi Berkine complex. According to figures from state firm Sonatrach, Algerian drilling rose 12.6% to 215 wells in 2014. This year, activity is expected to gain another 2.8%. During 2014, Sonatrach struck 30 oil and gas discoveries, and two more were made in partnership with other firms.

A licensing round in 2014 did not draw any bids, due possibly to the perception of a security risk following a terrorist attack on the In Amenas gas complex in 2013, which was operated jointly by Statoil and BP. Some of the expatriate workers are slowly returning. As a result of earlier licensing rounds, several international operators are working in Algeria. Among these is the Reggane Nord consortium, which includes RWE DEA. The consortium has commenced development drilling at the gas project in the Algerian Sahara. Twenty-six development wells are planned for the first drilling campaign. The start of gas production is scheduled for the summer of 2017. The first development well, KL-39, was spudded at the end of January. In addition, Statoil and Shell, in partnership with Sonatrach, will be testing a potentially large shale resource play in the Illizi-Ghadames basin.

SUDAN AND SOUTH SUDAN

Civil conflict and low oil prices continue to stifle the Sudan’s oil and gas industry in Sudan and South Sudan. According to industry analyst Global State, production in oil-rich South Sudan has dropped from 240,000 bpd in 2013 to 165,000 bpd in 2014. It is likely that 2015 production will fall even further, due to an escalation of conflict near the oil fields. Industry experts suggest that the damage to the infrastructure has been so severe, that it will take at least seven years to bring back production to 2013 levels.