By Platts

U.S. gasoline stocks fell 5.19 million barrels to 210.44 million barrels during the reporting week ended April 4, Energy Information Administration (EIA) data showed Wednesday, outpacing analysts' expectations.

Analysts surveyed Monday had expected U.S. gasoline stocks to have fallen 1.3 million barrels.

Draws were seen across every region of the U.S. amid a 283,000 barrels per day (b/d) increase in implied demand*, which rose to just under 9 million b/d. On a four-week moving average, implied demand at 8.81 million b/d is at its highest since the week ended January 3, when it was 8.84 million b/d.

Stocks on the U.S. Atlantic Coast (USAC) -- home to the New York Harbor-delivered New York Mercantile Exchange (NYMEX) RBOB contract -- fell 1.22 million barrels to 53.9 million barrels. This puts USAC gasoline stocks 5.41 million barrels below year-ago levels.

Despite the draw, however, stocks are just 3.9% below the five-year average of EIA data, down from almost 4.6% below the five-year average the week ended March 28.

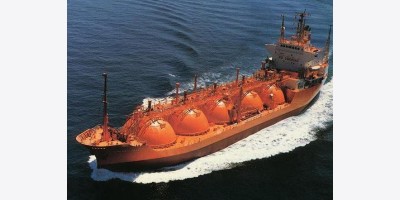

The present tightness could be alleviated soon as imports are likely on their way. According to Platts cFlow vessel-tracking software, between April 10 and April 22 seven clean product tankers are scheduled to arrive in Bayonne, New Jersey, from the U.K.-Continent. It is unclear, however, how many of those ships are laden with refined products.

EIA data does not yet reflect these incoming cargoes, pegging USAC gasoline imports 80,000 b/d lower the week ended April 4 at 433,000 b/d.

Stocks on the U.S. Gulf Coast (USGC) -- which supplies much of the USAC via the Colonial Pipeline -- also dropped, having fallen 2.27 million barrels the week ended April 4. Yet USGC stocks at 74.54 million barrels are still well-supplied, sitting at a 4.3% surplus to the five-year average.

U.S. Midwest gasoline stocks tightened further, falling 101,000 barrels. At 47.25 million barrels, they remain more than 10% below the five-year average. U.S. West Coast (USWC) gasoline stocks also fell, down 1.13 million barrels to 28.62 million barrels. This puts USWC gasoline stocks more than 8.5% below the five-year average.

U.S. distillate stocks rose 239,000 barrels to 113.19 million barrels the week ended April 4, counter to analysts' expectations of an 800,000-barrel draw.

Combined USAC low- and ultra-low sulfur diesel stocks are recovering from the winter cold, having risen 731,000 barrels the week ended April 4 to 24.28 million barrels, putting them just 3% below the five-year average.

USAC stocks were more than 34% below the five-year average as recently as the week ended February 7, amid heavy demand brought on by brutally cold winter temperatures.

Combined USGC stocks fell 592,000 barrels to 32.23 million barrels.

STRATEGIC PETROLEUM RESERVE (SPR) STOCKS DRAW, PRODUCTION UP

EIA data showed a slight net reduction in SPR stocks of 240,000 barrels. SPR crude oil in storage now totals 695.73 million barrels, down from 695.97 million barrels. The SPR is the U.S. government's safety-net of oil supply.

This reduction reflected a portion of the 5 million-barrel test sale of SPR crude oil by the U.S. government, announced March 17, according to Rob Merriam, manager of EIA's Weekly Petroleum Status report.

U.S. domestic crude oil production at 8.23 million b/d is the highest since the 8.24 million b/d seen the week ended May 27, 1988.

USGC CRUDE OIL IMPORTS, RUNS REBOUND

U.S. commercial crude oil stocks jumped 4.03 million barrels to 384.12 million barrels the week ended April 4, amid a massive rebound in USGC imports, which soared 673,000 b/d to 3.65 million b/d.

Analysts surveyed Monday by Platts were looking for a 2.5 million-barrel build.

USGC crude oil stocks rose 3.03 million barrels to just over 202 million barrels the week ended April 4, besting the previous record-high set the week ended March 21.

Imports had been curtailed two weeks ago following a bunker fuel spill which had temporarily shut the Houston Ship Channel to incoming and outgoing traffic. Total U.S. imports rose 481,000 b/d to 7.31 million b/d.

Imports from Venezuela, Iraq, Kuwait and Mexico -- most of which head to the USGC -- all rallied the week ended April 4. Imports from Venezuela rose 332,000 b/d to 1.03 million b/d – the highest since early February. Imports from Iraq rallied to 401,000 b/d, up from just 85,000 b/d, while those from Kuwait rose 310,000 b/d to 505,000 b/d. Imports from Mexico rose 134,000 b/d to 908,000 b/d.

The build comes despite a rebound in USGC crude oil runs, which jumped 167,000 b/d to 8.22 million b/d. This helped boost USGC utilization rates 1.6 percentage points to 91.3% of capacity, the highest since the week ended January 10, when USGC refineries were operating at 91.7% of capacity.

Total operable capacity in the USGC rose 61,000 b/d to 9.15 million b/d. This is the first time USGC operable capacity has changed since the week ended May 3, when it fell to 9.09 million b/d from 9.1 million b/d.

Total U.S. refinery utilization fell 0.2 percentage point to 87.5% of capacity, in line with analysts’ expectations.

U.S. Midwest crude oil runs dropped 133,000 b/d to 3.19 million b/d, bringing utilization rates in the region 4.7 percentage points lower to 83.7% of capacity. Midwest operable capacity also rose the week ended April 4, up 49,000 b/d to 3.82 million b/d. EIA data had pegged Midwest operable capacity at 3.77 million b/d from the week ended April 5, 2013.

Crude oil stocks at Cushing, Oklahoma -- delivery point for the NYMEX crude oil futures contract -- rose for the first time in 11 weeks, up 345,000 barrels to 27.6 million barrels.

Total Midwest stocks rose 701,000 barrels to 97.51 million barrels.