by Platts Markets

U.S. crude oil stocks jumped 10 million barrels the week ended April 11 -- the largest build in 13 years -- on a surge in imports and lower refinery run rates in the U.S. Gulf Coast (USGC), data from the U.S. Energy Information Administration (EIA) showed Wednesday.

The crude oil build, to 394.1 million barrels for the April 11 reporting week, puts stocks at a 7.4% surplus to the EIA five-year average. The surplus has risen from 2.8% just six weeks ago.

Analyst Kyle Cooper of IAF Advisors said a 10 million-barrel build in commercial crude oil stocks was not typical for this time of year. He noted, though, that the total build was closer to 9.4 million barrels, as some 600,000 barrels of crude oil was reduced from the U.S. Strategic Petroleum Reserve (SPR). The SPR is the U.S. government's safety-net of oil supply.

The decline in SPR puts that storage at 695.1 million barrels as of the week ended April 11. This reduction reflects a portion of the 5 million-barrel test sale of SPR crude oil by the U.S. government announced March 17.

Rob Merriam, manager of EIA's Weekly Petroleum Status Report, said a large build of this size in commercial crude oil stocks is typically seen in January, when companies are replenishing barrels after shedding crude oil at the end of the year for tax purposes.

"It was a strong build this week," Merriam said. "We did have a large rebound in imports and domestic production continues to boom along."

U.S. crude oil imports rose 959,000 barrels per day (b/d) to 8.27 million b/d, led by a 649,000 b/d increase in imports from Saudi Arabia and a 406,000 b/d increase in imports from Colombia.

At the same time, U.S. crude oil production continues to grow. Domestic crude oil production reached 8.3 million b/d the week ended April 11 -- the highest since the 8.306 million b/d seen the week ended April 1, 1988.

In a survey on Monday, analysts polled by Platts were expecting a 2.4 million-barrel build in crude oil stocks for the reporting week ended April 11.

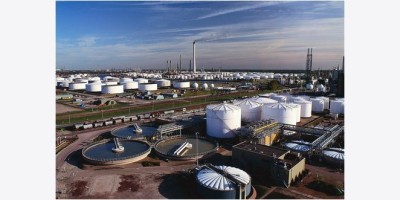

USGC STOCKS HIT NEW RECORD HIGH

USGC crude oil inventories continued to reach record levels the week ended April 11, with stocks hitting 207.2 million barrels -- the highest on record for EIA data. The build puts stocks up 5.2 million barrels from the week ended April 4.

Crude oil stocks on the U.S. West Coast rose 4 million barrels the week ended April 11 to 55.8 million barrels.

Stocks in Cushing, Oklahoma -- delivery point for the New York Mercantile Exchange (NYMEX) crude oil futures contract -- fell 800,000 barrels to 26.8 million barrels, putting inventories at the key hub at a 31.2% deficit to the EIA five-year average.

Overall, U.S. refinery runs rose 1.3 percentage points to 88.8% of capacity the week ended April 11, though USGC refiners reduced runs by 1.4 percentage points to 89.9% of capacity.

In the U.S. Midwest, refiners upped run rates by 7.5 percentage points to 91.2% of capacity. That is far above year-ago run levels of 82.7% of capacity.

Phillips 66 was performing unspecified planned maintenance at its 260,000 b/d Alliance refinery in Belle Chasse, Louisiana, a spokesman said the week ended April 11. Also, a boiler was shut April 9 at Tesoro's 166,000 b/d Golden Eagle refinery in Martinez, California, a market source said.

Analysts also noted that Philadelphia Energy Solutions has completed a maintenance turnaround at its 350,000 b/d Philadelphia refinery.

U.S. GASOLINE, DISTILLATE STOCKS DECLINE

U.S. gasoline stocks fell 200,000 barrels to 210.3 million barrels the week ended April 11, putting stocks more than 11 million barrels lower than the same week in 2013.

Gasoline stocks on the U.S. Atlantic Coast (USAC) -- home of the New York delivery point for NYMEX RBOB -- rose 300,000 barrels to 54.2 million barrels the week ended April 11. The build was offset by a 700,000-barrel draw on the USGC and a 900,000-barrel decline on the U.S. West Coast.

Analysts polled by Platts were anticipating a larger, 1.7 million-barrel draw in gasoline stocks.

Implied demand* for the motor fuel fell 380,000 b/d to 8.62 million b/d.

U.S. distillate stocks fell 1.3 million barrels the week ended April 11 to 111.9 million barrels, more than analysts' estimates of a 200,000-barrel draw.

Demand for distillate fuel rose 238,000 b/d to 4.17 million b/d.

USAC combined low- and ultra-low sulfur diesel stocks at 24.88 million barrels for the week ended April 11 were in line with the EIA's five-year average. That is narrowed from a deficit of more than 34% just nine weeks earlier. Stocks rose 613,000 million barrels from the week ended April 4.