Sep Basrah Light nominations up 117,000 b/d to 2.307 million b/d from Aug

Basrah Light crude oil nominations, to lift in September, was put at 2.307 million b/d, up 117,000 b/d from the August nominations, according to the latest loading schedule obtained by Platts Wednesday.

A total of 69.195 million barrels, or 2.307 million b/d, of Basrah Light crude is expected to be lifted from the Persian Gulf port of Basra, which includes Basrah Oil Terminal and Khor Al Amaya Oil Terminal.

Iraq’s State Oil Marketing Organization earlier in the month set the September official selling price for Basrah Light crude bound for Asia at $1.00/b discount to the average of Platts Dubai and Oman assessments in September, for Europe at Platts Dated Brent minus $4.20/b and for the US at ASCI plus $0.40/b.

The OSP for Asia was equivalent to $0.65/b discount to the Saudi Arabian Medium’s September OSP, and for the US, Basrah Light’s OSP was a $0.20/b discount to Arabian Medium’s OSP.

The lifters scheduled to load Basrah Light in September include Bharat Petroleum, Hindustan Petroleum Corp. Ltd, Shell Majnoon, China National Offshore Oil Corp., CNPC, Sinochem, Unipec, CEPSA, ExxonMobil, PetroChina West Qurna, Litasco, JX Nippon, Valero, Japex Garraf, BP, Saras, Repsol, ENI, GS Caltex, Zhenhua Oil, Indian Oil Corp. Ltd., Motor Oil Hellas, Petro Diamond, Pertamina, Shell, Valero, Koch, JX Nippon Energy, API Oil, Petronas, BP, China Oil, Repsol, Total, Toyota, Petronas, ERG Lukoil, Chevron, Al Waha and Phillip 66.

Unipec fixes VLCC of Urals to East as Brent-Dubai slides

Unipec has fully fixed the British Vantage VLCC to take a crude cargo from Skaw in the North Sea to Ningbo in China, shipping sources and traders said Wednesday, with traders indicating the shipment is expected to be made up of Aframax cargoes from the Baltic Sea Urals program.

According to shipping sources, the 270,000 mt cargo has a laycan for September 10-13 and was fixed at a $5.75 million lump sum. “The ship is fully fixed to carry Urals East for Unipec I believe,” a charterer active in the North Sea said.

Trading sources said the volume is expected to consist of several smaller cargoes from the Urals-loading ports of Primorsk and Ust-Luga in the Baltic Sea, marking the first VLCC shipment of Urals east from the Baltic Sea in several months. “They have [several] cargoes of Urals in the first 10 days of the September loading program,” a crude trader said.

Unipec is a regular buyer of Urals crude out of both the Baltic and Black Seas, and have been seen to send crude East from both locations, but market sources said it has been some time since a VLCC of Urals has been assembled at the ship-to-ship transfer area at Skaw to move to Asia.

The falling premium of Brent crude futures over Dubai crude swaps in the past few weeks has encouraged Asian refiners to buy more crudes priced against Dated Brent for September and October loading, market sources said.

The front-month Brent/Dubai Exchange of Futures for Swaps (EFS) — which enables holders of ICE Brent futures to exchange their Brent futures position for a forward month Dubai crude swap — has been hovering around $1.07/b and $1.13/b over the past week, compared to a month ago when it was ranging between $2.50 and $2.60/b.

The EFS spread has been narrowing steadily as the ICE Brent futures contract has dropped to year lows, reflecting a weak physical market in the North Sea. A representative from Unipec declined to comment.

Russian Bashneft’s Aug crude output highest since 1994 at 365,000 b/d

Average crude production by Russia’s Bashneft increased to 50,000 mt a day, or 365,000 b/d,

in August, the highest since 1994, the company’s CEO, Alexander Korsik, said Wednesday. Korsik was speaking during a conference call on the company’s second-quarter results.

The growth in production was supported by an increase in production from brownfields where company is implementing enhance oil recovery technology. “I’m really happy with what is going on the brownfields,” Korsik said. “If you recall, we promised to maintain production [at the brownfields] for the foreseeable future...and are seeing a certain amount of growth [instead],” Korsik said. “I hope we can continue this for as long as possible,” he added.

Bashneft’s output in Q2 averaged 350,900 b/d, up 11.5% year on year, the company said earlier this month. The strong growth in crude production was driven by a 2.6% increase in production at the company’s brownfields, mainly in the Republic of Bashkortostan, due to efficient geological and engineering operations, as well as production at the greenfield Trebs and Titov project, and a purchase of West Siberian Burneftegaz upstream unit in March, it said.

Korsik also said that Bashneft had completed a 2D seismic survey at its Block 12 in southern Iraq in July and had started a 3D survey in August. The work at the block is continuing as normal, despite the violence in the country, he said. “Fortunately, the area of our operations is not affected by the insurgency. So we’re able to continue our operations there.”

Bashneft holds a 70% stake and is operator of the Block 12 near the Saudi Arabian border, while UK independent Premier Oil has 30%.

Finally, Bashneft’s CFO Denis Stankevich said that Bashneft would not need any additional financing this year, when asked about the company’s financial situation in the context of sanctions the US and the EU imposed on Russia, and in particularly those that limit access to funding.

“In Q2, we did a very good job in relation our debt portfolio and moved all the payments to later periods,” Stankevich said during the conference call.

Cairn Energy strikes oil shows off Senegal

Cairn Energy has struck oil at its FAN-1 exploration well, the first deepwater well to be drilled in Senegalese waters, joint venture partner FAR of Australia said Wednesday.

The presence of oil was confirmed by an intermediate logging program that confirms the existence of a working petroleum system, FAR said in a statement. Conclusive results for the well, which is located in the Sangomar Deep block, will not be available until drilling operations are completed and all the well data is fully assessed, it said.

The well, the second in a two-well program off Senegal, was testing a stacked fan structure with a potential to contain 900 million barrels of oil. Cairn Energy, which is the operator of the Sangomar Deep block, declined to comment Wednesday as the well is still drilling.

FAR expects drilling of the well to be completed during the next month. The rig will then be moved to recommence drilling of the SNE-1 well, which has been drilled to a total depth of 1,900 meters but will be drilled to approximately 3,300 meters. “The presence of oil in the secondary target is important in helping our geological understanding of the margin and is significant because it confirms the existence of a working petroleum generating system,” FAR Managing Director Cath Norman said.

FAN-1 is a “pure exploration well” and, even if successful, will not be completed as a commercial production well, FAR said. In the event of a success, the joint venture may decide to conduct further drilling and evaluation activities.

Senegal’s national oil company, Petrosen, said it was encouraged by the results of the well but added that it was early days as the companies would have to drill to a deeper depth to establish if the results are commercial. “We have had oil shows and it has proved that there is a working petroleum system. The game now is to find the reservoir in the area.

Drilling is ongoing and the results so far are very encouraging,” company director for exploration and production Al Housseynou Wane said. “The next stage is going to very important and we expect final results at the end of the month,” Wane said.

North Sea Buzzard field output resumes after maintenance

The UK’s offshore Buzzard field resumed production Wednesday after being offline for maintenance since the end of July, operator Nexen said. “Export of oil from Buzzard resumed at 1555 hours on Wednesday, August 26, with production ramping up over the next week,”

the company said in a statement. “Rig demobilization work will continue as weather conditions allow.”

Buzzard temporarily restarted production late Monday, before being shut down again to allow for the demobilization of a drilling rig. The field’s summer maintenance started on July 28. This was timed to coincide with a full 14-day system shutdown of the Forties Pipeline on August 1 for the installation of a subsea isolation valve into the Forties Main Oil pipelines at Forties Charlie.

The Buzzard field has a nameplate capacity of 220,000 b/d. It is typically the largest contributor to Forties Blend, which is one of the four grades underpinning the Dated Brent benchmark. The Buzzard maintenance period has sharply reduced the overall volume of Forties production. Forties Blend unstabilized crude output is expected to average 156,600 b/d in August, compared with 374,000 b/d in July, according to BP.

By Volodymyr Verbyany, Holly Rosenkrantz and Ilya Arkhipov Aug 28, 2014 4:00 AM GMT+0700

Aug. 27 (Bloomberg) -- Russian President Vladimir Putin said talks with his Ukrainian counterpart on ending separatist fighting that’s killed more than 2,000 people were “positive” as the parties began discussions on a political resolution. Hans Nichols reports on “Bloomberg Surveillance.” (Source: Bloomberg)

The U.S. said Russia may be directing a counteroffensive by separatist rebels in Ukraine as fighting in the battle-torn country’s easternmost regions spread to previously peaceful areas.

Jen Psaki, the U.S. State Department spokeswoman, cited the reports of fresh fighting, telling reporters in Washington yesterday that “these incursions indicate a Russian-directed counter-offensive is likely under way in Donetsk and Luhansk.” Russian President Vladimir Putin’s spokesman, Dmitry Peskov, said “this information doesn’t correspond with reality.”

The violence in Ukraine expanded a day after Putin met his Ukrainian counterpart, Petro Poroshenko, and hailed the talks as a step toward a political resolution. The government in Kiev said the fighting, which has claimed more than 2,000 lives according to the United Nations, has spread to the shores of the Sea of Azov, effectively opening a new front.

“There is little chance of a diplomatic breakthrough or a durable peace at the moment,” Alex Brideau, an analyst at Eurasia Group in Washington, said by e-mail. “None of the key parties -- Ukraine, the Donbass militants, or Russia -- has strong incentive to compromise. The fighting is increasingly headed towards a ‘frozen conflict.’”

Artillery, Rockets

Ukraine and its allies blame Russia for stoking the insurgency in the east with manpower and weapons, an allegation Russia denies. The five months of unrest have sparked the worst standoff between Russia and its former Cold War foes in two decades and unleashed sanctions on both sides.

The Kremlin is more openly backing the rebels in the wake of military successes by Ukrainian government troops, now with small Russian military formations moving into its neighbor’s territory, a senior NATO diplomat told reporters in Brussels on condition of anonymity. Russia has provided artillery and rocket support for the insurgents, from positions on both sides of the border, the diplomat said.

A Snapshot of Ukraine's Past and Future

“It’s high time to finally protect this border and for any kind of military support of the separatists across this border to cease,” German Chancellor Angela Merkel’s chief spokesman, Steffen Seibert, told reporters yesterday in Berlin. “Russia has a big responsibility here.”

Not Party

Russia regularly denies allegations that it’s involved in the fighting. In Minsk, Putin said there were no talks on conditions for a cease-fire because Russia isn’t a party to the conflict.

“We are not interested in pulling” the Ukrainian “state apart,” Russian Foreign Minister Sergei Lavrov said yesterday, adding that the rights of Russians should be defended everywhere.

Reports of Russian troops on Ukrainian soil need to be explained, Merkel told Putin during a phone call yesterday, Siebert said in an e-mail. The two leaders discussed the Minsk talks and both stressed the importance of continuing international efforts to promote de-escalation in Ukraine, Kremlin officials said in a statement about the call.

Putin also informed Merkel about Russia’s plans to send humanitarian aid to eastern Ukraine, according to the statement. The U.S. and the European Union condemned the decision to send the first convoy of about 280 trucks last week, which the government in Kiev called an “invasion” after it crossed the border without authorization.

Peskov said that Russia is ready to send the aid “tomorrow” as Ukraine needs help as soon as possible. Shipments would be delivered in agreement with Ukraine and the Red Cross, he said.

‘Reinforce Separatists’

“The Russians are all about process and are clearly playing for time to reinforce separatist positions or put in more troops and arms,” Joerg Forbrig, senior program officer for central and eastern Europe at the Berlin bureau of the German Marshall Fund of the U.S., said by phone.

Ukraine’s military said yesterday that its forces killed 225 rebels and destroyed three tanks in the previous 24 hours. Thirteen government soldiers were killed and 36 wounded, a military spokesman, Andriy Lysenko, said at a briefing in Kiev.

Government forces were shelled “intensively” from Russian territory and were under attack from insurgents around Mariupol and Novoazovsk on the Sea of Azov coast, south of the rebel strongholds of Donetsk and Luhansk, Lysenko said. Government forces are in control of Novoazovsk, on the Russian border, he said.

No Action

Ukrainian troops are also fighting to maintain control of Ilovaysk, east of Donetsk, and two other towns, the military press service said on Facebook. There was no independent confirmation of the military figures for separatist deaths.

Yevhen Perebyinis, spokesman for Ukraine’s Foreign Ministry, told reporters in Kiev yesterday that “so far we have not seen concrete actions from Russia” to bring about a peaceful’’ resolution of the conflict and that words must be followed by deeds.

Poroshenko told reporters that attempts would be made to hold talks about a cease-fire “as soon as possible” though a trilateral contact group involving Ukraine, Russia and the EU. A truce would then be monitored by the Organization for Security and Cooperation in Europe, he said.

To contact the reporters on this story: Volodymyr Verbyany in Kiev at vverbyany1@bloomberg.net; Holly Rosenkrantz in Washington at hrosenkrantz@bloomberg.net; Ilya Arkhipov in Moscow at iarkhipov@bloomberg.net

To contact the editors responsible for this story: Balazs Penz at bpenz@bloomberg.net; James M. Gomez at jagomez@bloomberg.net Larry Liebert

By Andrew Langley and Kateryna Choursina Aug 28, 2014 4:00 AM GMT+0700

Hours after Vladimir Putin hailed “positive” talks over the war in Ukraine, new accusations of Russian aggression were already being voiced in Kiev.

While the Russian president reiterated a pledge early yesterday to do all he can to bring peace to the war-torn Donetsk and Luhansk regions, officials in Ukraine said he was doing just the opposite. Russian soldiers have joined rebel fighters in mounting a counterattack, opening a new front against Ukrainian troops who are being shelled “intensively” from across the border, military spokesman Andriy Lysenko said.

The pattern has become a familiar one: Putin annexed the Black Sea peninsula of Crimea after saying he had no intension of doing so; a promise in Switzerland to help bring the separatists to heel preceded more intense fighting. The aim is to muddy the waters and reduce the risk of more penalties from the U.S. and Europe, according to Otilia Dhand, an analyst at Teneo Intelligence in London who specializes in eastern Europe.

“The Kremlin is playing a double game of sending out positive messages -- to reduce the risk international sanctions will be expanded while preparing for an escalation,” Dhand said by e-mail.

Putin met his Ukrainian counterpart, Petro Poroshenko, at a regional summit in the Belarusian capital Minsk on Aug. 26, their first face-to-face meeting since June. Russia “will do everything for this peace process,” Putin told reporters after the talks, while continuing to deny any Russian involvement in a conflict that’s already claimed more than 2,000 lives.

No Compromise

Poroshenko said all parties backed a Ukrainian peace plan at the talks, which included the Belarusian and Kazakh leaders as well as European Union foreign-policy chief Catherine Ashton. A “road map” will be drawn up and a three-way contact group involving the EU and Russia will work on a truce, he said.

The positive spin from Russia and Ukraine doesn’t amount to much, according to Fredrik Erixon, director of the European Center for International Political Economy in Brussels. All the talks produced was an agreement to hold more meetings, he said.

“The Kremlin’s long-term strategy is to destabilize Ukraine -- not to take over its territory but to keep it weak,” Erixon said today by phone. “The notion that you reach a compromise deal with Putin through more talks, well, I just don’t see that.”

Intensified Fighting

Fighting on the ground in Ukraine’s easternmost regions is intensifying, not ebbing. Ukraine maintains Russia is supplying the rebels with arms, financing and manpower that now includes regular troops. Russian servicemen are among a group of fighters that seized a village inside the Donetsk region, according to Lysenko.

Overnight incursions in eastern Ukraine suggest a “Russian-directed counteroffensive is likely under way” in Donetsk and Luhansk, U.S. State Department spokeswoman Jen Psaki told reporters in Washington yesterday.

Russia is more openly backing the Ukrainian separatists, now with small Russian military formations moving into Ukraine’s territory, a senior NATO diplomat told reporters in Brussels yesterday, speaking on the condition of anonymity.

The Kremlin has provided artillery and rocket support for rebels, from positions both in Russia and inside Ukraine and SA-22 surface-to-air missiles now being deployed are more sophisticated than the SA-11 missiles that downed the Malaysian airliner, the diplomat said.

Russia Denies

Putin’s spokesman, Dmitry Peskov, speaking to reporters in Moscow said these NATO “statements are not new. Russia regularly denies these allegations.”

Ukraine on Aug. 26 released a video of Russian paratroopers captured after traveling in an armored column 15 kilometers (9 miles) over the border. While Putin said they accidentally strayed over the frontier, the Defense Ministry in Kiev said later that part of the column remains in Ukraine and is shelling the army from positions in three villages.

“For the past half year we’ve heard very many loud statements from Russia but so far we’ve not seen any concrete action,” Foreign Ministry spokesman Yevgen Perebyinis told reporters in Kiev. “These words by Russia’s leaders could become reality in one day by giving the order to its military to leave Ukrainian territory and to close the borders.”

There’s still reason for optimism, according to Vladimir Tikhomirov, chief economist at BCS Financial Group in Moscow. With expectations low before the Minsk talks, the fact the two sides decided to continue talking is “a good thing,” he said.

More Progress

“Although breakthrough agreements are still some time away, we expect to see more progress in the political, military and economic and trade areas in the next few weeks,” Tikhomirov said in a research note. “With the negotiation process now started, a new wave of Russia-West confrontations has become less likely.”

The U.S. and its allies aren’t buying Putin’s claim that he’s just an innocent bystander. They’ve imposed financial restrictions on some of his closest allies, including billionaire Gennady Timchenko, and several of the country’s biggest companies, including oil champion OAO Rosneft. Those measures have helped push Russia’s already flagging $2 trillion economy to the edge of recession.

The Obama administration said last week that Russia violated Ukraine’s sovereignty by sending in a convoy of humanitarian-aid trucks without government permission and risks deeper sanctions if they’re not removed. The convoy has since left Ukraine, though Russia says another is planned.

Micex Up

Still, investors continue to react positively to Putin’s conciliatory remarks. The Micex (INDEXCF) Index of 30 stocks gained 0.5 percent yesterday, advancing for the 12th time in 14 sessions, while the ruble strengthened 0.1 percent against the dollar, data compiled by Bloomberg show.

With Ukraine complaining yesterday of more shelling from Russia as well as air-space violations from its neighbor, markets in Kiev were less upbeat. Dollar-denominated 2017 government debt fell, pushing the yield up 23 basis points to 10.896 percent, near a three-week high.

There’s little reason to be hopeful about ending this war, said Vladimir Pribylovsky, head of the Moscow-based Panorama research group. Given that the two sides couldn’t even agree in Minsk on “basic facts” such as Russia’s involvement, there’s not much to discuss, he said.

“Putin is leaning on the old good cop-bad cop trick,” Pribylovsky said by phone. “While reality points to an aggressive Russia, Putin is trying to show he’s a reasonable partner.”

To contact the reporters on this story: Andrew Langley in London at alangley1@bloomberg.net; Kateryna Choursina in Kiev at kchoursina@bloomberg.net

To contact the editors responsible for this story: Balazs Penz at bpenz@bloomberg.net Brad Cook, Paul Abelsky

New York (Platts)--27Aug2014/520 pm EDT/2120 GMT

NYMEX October crude settled nearly unchanged Wednesday after US Energy Information Administration oil data showed US commercial crude stocks fell last week, largely in line with analysts expectations.

Front-month crude settled 2 cents higher at $93.88/barrel. ICE October Brent, meanwhile, finished 22 cents higher at $102.72/b. Products were mixed, with NYMEX September ULSD settling 1.63 cents higher at $2.8605/gal. September RBOB finished 1.72 cents lower at $2.7459/gal.

US crude stocks fell 2.07 million barrels to 360.48 million barrels for the reporting week ended August 22, EIA data showed. Analysts surveyed Monday by Platts had been expecting a 2.5 million-barrel draw.

US gasoline stocks fell 960,000 barrels to 212.31 million barrels last week, while distillate stocks rose 1.25 million barrels to 122.79 million barrels.

"The market really ignored the drop [in crude stocks], but the market holding around $93-$94/b wasn't really ever predicated on the stats," Tradition Energy analyst Gene McGillian said.

Front-month crude has held in a narrow $2/b range over the past week, after having fallen nearly $12/b since late-July.

EIA data showed US crude production at 8.63 million b/d last week, the highest weekly reading since late-October, when production was 8.77 million b/d. Data also showed US Gulf Coast crude runs hit a fresh record-high of 8.75 million b/d.

But expected US refinery maintenance season this fall will likely knock this figure back soon, and has kept NYMEX crude testing the $92.50/b support levels, McGillian said.

As part of planned maintenance, ExxonMobil said Wednesday that it took a fluid catalytic cracker down at its 584,000 b/Baytown, Texas, refinery. The unit will likely be down for several weeks.

Baytown is the second largest refinery in the US.

Front-month crude likely already priced-in the maintenance, McGillian said, adding that there will probably be several more refineries announcing similar cuts in the next few weeks.

"Refinery announcements don't make as much noise in the market as they used to," McGillian said. "Trade flow these days is dominated by the momentum traders, trying to flush movement and drive the market in one direction, until buying or selling dries up, and then they change direction."

Meanwhile, McGillian said the Brent market was still focused more on economic growth in Europe and China, as well as with the abundance of physical supply weighing on global markets.

The North Sea Buzzard field resumed production Wednesday following planned maintenance. This will likely add even more spot barrels to an already well-supplied European market. Buzzard is home to North Sea Forties grade, a key element of the Dated Brent complex.

Platts assessed Forties 9 cents lower at Dated Brent minus 55 cents/b Wednesday.

London (Platts)--27Aug2014/706 am EDT/1106 GMT

The premium of Northwest European ultra low sulfur diesel cargoes to front-month 0.1% gasoil futures hit its highest level in over four months Tuesday on a surge of prompt demand for cargoes into Le Havre, Hamburg and the Thames.

Diesel cargoes were assessed by Platts at $25/mt Tuesday, up $3.25/mt from the previous close to its highest since April 14.

Tightness in the flexi 20,000 mt cargo market contrasts the healthy supply picture supported by volumes arriving on larger Medium Range 38,000 mt vessels from the US over September.

"There have been a lot of bids in the window -- the [flexi] size is more and more difficult to find so it's logical there are not many fixes...the US arb has been shut for a while so there is potential for differentials in Europe to go up, as the market continues to be tight," one trader said.

A total of 16 vessels carrying an estimated 710,000 mt of diesel departed from the US for arrival into Europe last week, with 970,000 mt so far tracked to arrive during the first two weeks of September, according to Platts ship tracking software cFlow.

The premium of CIF cargoes to FOB barges reached $7.75/mt. At these levels buying from the barge market to meet demand looked more economical, and with stock levels in the ARA distribution and storage hub in the region at 25% higher than year-ago levels, according to the latest inventory data released by BNP Paribas last week.

However, with a $4/mt contango structure between front- and second-month 0.1% ICE gasoil futures making it more attractive for barrels to remain in storage, spot buyers had to pay higher premiums to access volumes from the barge market. FOB Rotterdam barge premiums closed at $17.25/mt Tuesday, their highest since April 17.

Hanoi (Platts)--27Aug2014/311 am EDT/711 GMT

Vietnam produced an estimated 1.284 million mt or 303,604 b/d of crude oil in August, up 2.9% year on year, according to data released late Tuesday, August 26, by the General Statistics Office.

The country exported about 985,000 mt of crude in August, up 37.4% from August 2013.

Over January-August, Vietnam produced an estimated 10.1 million mt of crude, down 0.8% from the same period of 2013.

It exported 6.38 million mt of crude in the first eight months of the year, up 11.8% year on year.

Vietnam's rising crude exports over January-August came as the country's sole 130,000 b/d Dung Quat refinery in the central Quang Ngai province was shut for a planned turnaround from May to July.

The country produced an estimated 750 million cubic meters of natural gas in August, up 0.5% from the same month in 2013, the GSO said.

Over January-August, the country pumped an estimated 6.94 billion cubic meters of gas, up 2.4% year on year.

State-owned PetroVietnam, through its gas arm PV Gas, supplies natural gas to meet more than 40% of Vietnam's electricity and 70% of its fertilizer consumption.

Buenos Aires (Platts)--27Aug2014/332 pm EDT/1932 GMT

Argentinian natural gas imports in July rose to a record 44.6 million cubic meters/day, 1.6% above the July 2013 level, the government's energy secretariat said Wednesday.

July gas imports, which accounted for 35% of the 126 million cu m/d the country used, were up from 43.9 million cu m/d in the year-earlier period and 42.6 million cu m/d in June.

Argentina, which relies on gas to meet half of its energy needs, imports supplies by pipeline from Bolivia and LNG from global suppliers.

Bolivian gas imports totaled 17.1 million cu m/d in July compared with 16.9 million cu m/d in July 2013 and 17.4 million cu m/d in June.

LNG imports averaged the equivalent of 27.5 million cu m/d in sendout capacity in July, the highest amount since the country started importing LNG in 2008. The imports were up from 26.7 million cu m/d in July 2013 and 25.1 million cu m/d in June, the government said.

Argentina has been increasing gas imports as domestic production declines after a decade of limited exploration, maturing reserves and few finds. Gas production fell to an average of 114 million cu m/d in the first half of 2014, down 20% from a record 143.1 million cu m/d in 2004, according to government data. Consumption in the first half of 2014 averaged 126 million cu m/d in the first half of 2014, 33% above 2003 levels on a growing economy and price controls that have made gas the country's cheapest source of energy, according to the national statistics agency Indec.

Argentina plans to boost Bolivian gas imports to 27.7 million cu m/d by 2017 as more pipeline capacity comes online.

LIQUID IMPORTS

The secretariat also said crude imports averaged 9,987 b/d in July, down from 25,363 b/d in June. Year-ago data was not provided.

Argentina hadn't imported crude for years until 2012 when it had to turn to overseas suppliers to make up for dwindling domestic production, in particular during times of higher demand in the June to September winter and the February-March harvest period and summer holidays. Crude production fell 36% to 540,000 b/d in 2013 from a record 847,000 b/d in 1998, according to the Argentine Oil and Gas Institute, an industry group.

Diesel imports in July totaled 19,749 b/d, down from 22,205 b/d in June. No gasoline imports were reported in July.

Warsaw (Platts)--27Aug2014/930 am EDT/1330 GMT

Poland will invest about Zloty 5 billion ($1.57 billion) in shale gas exploration by 2016, the country's treasury minister Wlodzimierz Karpinski said Wednesday.

"Polish energy security and independence is a government priority," Karpinski told parliament as he outlined the government's energy policy priorities until the end of its term next year, according to a treasury ministry statement.

"It's based on the search for our own raw materials and the maximum use of national resources. We want to take advantage of this opportunity for energy independence, which in Poland may derive from shale gas reserves, and that's why state companies will invest not less than Zloty 5 billion in unconventional exploration to 2016," he added.

State-controlled energy companies PGNiG and PKN Orlen are leading shale gas exploration in Poland, which is the most advanced in Europe. Both domestic and foreign operators have drilled 65 exploration wells since mid-2010.

However, the geology has proved more difficult than originally predicted and none has yet flowed gas at a commercial rate.

Karpinski said the government has drafted a bill to speed up exploration for unconventional hydrocarbons. The draft law would shorten the statutory time limits for the consideration of upstream activities, establish regional leaders as the single decision makers in administrative matters and remove certain levels of bureaucracy.

The bill will be sent to parliament for review and a vote in the coming months.

http://cdnph.upi.com/sv/b/upi/UPI-2061409147163/2014/1/4460254ac5d47d95c710523cf4deaf8d/New-gas-demand-price-driver-forecast-shows.jpg

WASHINGTON, Aug. 27 (UPI) -- Emerging and recovering demand for natural gas in North American could translate to an end to the era of cheap energy resources, a forecast shows.

Bentek Energy, a forecasting unit of energy reporting group Platts, said non-traditional and recovering sources of gas demand could pass the 5 million cubic feet per day mark by 2019.

These new sources of demand, from new export facilities for liquefied natural gas to more gas-fired power plants, could be a driver in a future North American shale market.

Rocco Canonica, lead author of a 50-page report on demand, said the trends show an era where cheap energy reserves sourced from shale basins in North America may be drawing to a close.

"If demand growth reaches its full potential, we could expect a tighter U.S. market and upward price pressure," he said in a statement Wednesday.

The American Petroleum Institute, which represents the interests of the energy sector, said the U.S. economy would be better off with more natural gas production, particularly if producers could tap into export markets.

A 2012 report from NERA Economic Consulting said there would be "net economic benefits" from exports.

© 2014 United Press International, Inc. All Rights Reserved. Any reproduction, republication, redistribution and/or modification of any UPI content is expressly prohibited without UPI's prior written consent.

MOSCOW, Aug. 27 (UPI) -- Russian oil company Gazprom Neft said it agreed Wednesday to accept rubles and the Chinese yuan for crude oil deliveries.

For exports from the Novoportovskoye field in the arctic, the company said it would accept the Russian currency, while China could use its own currency for oil delivered from the Eastern Siberia-Pacific Ocean pipeline.

The switch could help the Russian economy reduce its dependency on the U.S. dollar in an era when Western economies are imposing tough sanctions on Moscow in response to the ongoing crisis in Ukraine.

Gazprom Neft said it made $2.4 billion in net profits and increased production 4.1 percent during the first half of the year.

The U.S. Energy Information Administration, the statistical arm of the Energy Department, said in a July brief that exports of crude oil, petroleum products and natural gas accounted for 68 percent of all export revenues for Russia in 2013.

The first branch of the ESPO pipeline entered service in January 2010. Gazprom Neft started work in the arctic field in 2012.

AUSTIN, Texas, Aug. 27 (UPI) -- Texas oil production in July, the last full month for which data are available, increased more than 25 percent year-on-year, the state government said.

The Railroad Commission of Texas, the state's energy agency, said crude oil production in July averaged 2.15 million barrels per day, up from the 1.68 million bpd reported in July 2013.

The rise in production reflects a 31 percent increase in the number of drilling permits issued year-on-year.

For natural gas, the commission said production of 602 billion cubic feet in June is an 8 percent increase year-on-year.

Texas is the No. 1 oil producer in the nation. Combined with North Dakota, the No. 2 producer, they produced 120 million barrels of oil in April, the last full month for which data are available from the U.S. Energy Department.

Texas is host to the Eagle Ford shale reserve area, one of the most prolific shale basins in the United States.

http://cdnph.upi.com/sv/b/upi/UPI-2131409141726/2014/1/a03146ca1b4fc2ce1d97e91baa39fdfd/Chinese-oil-demand-declines.jpg

SINGAPORE, Aug. 27 (UPI) -- The decline in how much oil China needs is a reflection of a slowdown in its economy, analysis from Platts said Wednesday.

Apparent oil demand, a reflection of how much oil goes into domestic refineries combined with net oil product imports, decreased 2.1 percent in July year-on-year. From June, apparent oil demand dropped 6.2 percent to 9.61 million barrels per day.

"The weakness in China's oil demand reflects the ongoing slowdown in its economy," James Bourne, Platts associate editorial director for Asia news, said in an emailed statement.

That's in contrast to the Organization of Petroleum Exporting Countries, which said in its latest monthly oil market report Chinese oil demand should increase another 3.8 percent during the fourth quarter of the year.

Asian economies are growing at a faster rate than other major markets. OPEC said in a 97-page annual report published earlier this year that oil demand should increase most notably in China, Thailand and Indonesia.

OPEC said commercial oil inventories in China fell by 4.9 million barrels in June because of an 8 percent decline in imports and 1.4 percent decline in domestic oil production.

THE HAGUE, Netherlands, Aug. 26 (UPI) -- Royal Dutch Shell said Tuesday its second major natural gas discovery off the coast of Malaysia underpins its strategy to develop a clean energy future.

Andrew Brown, upstream director for international operations at Shell, said the company made a natural gas discovery in the Majoram-1 well, a deep-water well located about 110 miles off the Malaysian coast.

"We have a long history in the region, and the addition of new natural gas resources this year ensures we are able to continue to provide cost-effective, reliable, cleaner energy options for the future," he said in a statement.

The company in its statement offered no estimate of the size of the discovery.

Analysis from Wood Mackenzie said Malaysia is on pace to become one of the largest suppliers of liquefied natural gas in the world.

The energy consultant group said Tuesday gas supply potential could grow by more than 55 percent to 42 million tons per year by 2022.

The U.S. Energy Information Administration reports Malaysia has about 83 trillion cubic feet of proven natural gas reserves and is No. 3 in the world in terms of exports of liquefied natural gas behind Qatar and Indonesia.

Shell's gas discovery was its second in Malaysia this year.

http://cdnph.upi.com/sv/b/upi/UPI-4611409144439/2014/1/bfa86085911355c84fbaa119bab7eaa9/Tanzania-positioned-as-LNG-hub-BG-Group-says.jpg

LONDON, Aug. 27 (UPI) -- Following positive results from an appraisal well off the coast of Tanzania, energy company BG Group said the country is in a good position for LNG development.

BG Group said a test from an appraisal well at the Mzia discovery off the coast of Tanzania yielded a sustained gas flow rate of 101 million cubic feet per day. A similar well last year flowed at 57 million cubic feet per day.

BG Group Chief Operating Officer Sami Iskandre said the results are a "critical factor as we progress design of the upstream production facilities and infrastructure" tied to liquefied natural gas development.

Last year, energy consultant group Wood Mackenzie published a report saying Tanzania was a part of a growing number of emerging producers in East Africa. The report said output from Tanzania could help regional production increase from the current rate of 500,000 barrels of oil equivalent per day to 1.5 million barrels of oil equivalent.

BG Group said test results from offshore developments "provided further support for a hub development to supply a potential onshore LNG project" in Tanzania.

http://d.ibtimes.co.uk/en/full/1396172/royal-dutch-shell.jpg?w=720&h=429&l=50&t=40

European oil major Royal Dutch Shell is moving ahead with plans to sell a number of its Nigerian oilfields as it ploughs ahead with planned asset sales.

The Anglo-Dutch firm is leading a consortium that is close to selling a cluster of oilfields that include the Nembe Creek Trunk Line, for around $5bn (£3bn, €3.8bn,) according to the Financial Times newspaper.

The move is the latest attempt by a western oil company to pull out from the restive Delta region and the Nigerian market amid recurring incidents of infrastructure sabotage that have caused billions of dollars' worth of damage.

A deal is expected to be finalised in the next few weeks and the total figure for the sale could still change.

Shell "has signed sales and purchase agreements for some of the oil mining leases but not all that we are seeking to divest", Shell said in a statement. "The assets under consideration are OMLs 18, 24, 25, 29 and the Nembe Creek Trunk Line, but the process has not yet concluded."

Shell has already sold off around $8bn worth of assets this year after it announced plans to sell around $15bn worth of assets through 2015.

Indigenous oil companies have expanded in Nigeria in recent years, capitalising on a government plan to boost domestic control over the oil industry.

Shell has faced long-running criticism from human rights groups over its oil production operations in Nigeria.

The company had not taken effective measures to restore the damaged environment in the Niger Delta after oil production caused contamination of the water there, Amnesty International reported in August.

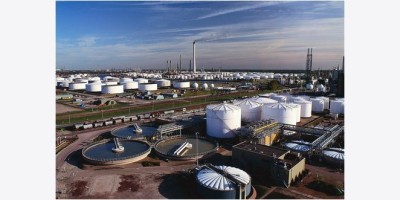

TEHRAN (FNA)- The National Iranian Oil Products Distribution Company (NIOPDC) underlined that construction of more storage facilities has always stood atop the oil ministry's agenda, and said the company is resolved to complete 5 half-finished storage tanks by March 2015.

Director of engineering and planning at the NIOPDC Abdollah Mollabaqer said that the NIOPDC has decided to reactivate construction of the half-finished storage projects and complete them before the end of current Iranian calendar year to March 2015.

He went on to say that the five mentioned storage facilities are located in Mahshahr, Birjand, Malayer, Shiraz and Orumiyeh having the capability to store 300, 105, 70, 170 and 120 million liters respectively.

Iran ranks the third globally in terms of oil reserves while having the world's second-largest natural gas reserves after Russia with 34 trillion cubic meters of natural gas reserves.

LONDON Wed Aug 27, 2014 11:57am BST

Aug 27 (Reuters) - Royal Dutch Shell has sold some of four oil fields up for grabs in Nigeria, it said on Wednesday, as the oil and gas company pushes ahead with global asset sales to cut costs.

Shell last year put up for sale its 30 percent shares in four oil blocks in the Niger Delta -- Oil Mining Licence (OML) 18, 24, 25, 29 -- as well as a key pipeline, the Nembe Creek Trunk Line.

"We have signed sales & purchase agreements for some of the Oil Mining Leases, but not all that we are seeking to divest," a Shell spokesman said.

No details were available on the value of the deals signed, nor when the full process will be completed.

France's Total and Italy's Eni are also set to raise revenue from the sale of their 10 percent and 5 percent shares in the assets. The Nigerian National Petroleum Corporation (NNPC) owns the remaining 55 percent.

The Financial Times on Wednesday reported that Shell is close to selling the assets for about $5 billion to domestic buyers.

In March, Reuters reported that Nigerian firms Taleveras and Aiteo made the highest bid of $2.85 billion for the biggest of the four oil fields, OML 29.

Shell, along with many other oil majors, is undergoing a broad process of asset sales across the world in an effort to cut costs and boost profits.

Other companies, including Total, Eni, Chevron and ConocoPhillips have sought to pull out of the oil-rich West African country which has been plagued by oil theft. (Reporting by Ron Bousso; editing by David Clarke)

DUBAI, 16 hours, 49 minutes ago

Saudi crude exports fell in June to their lowest levels in almost three years as oil use in the country's power sector rose and local refineries processed high volumes, official data showed.

The top oil exporter and Opec heavyweight exported 6.946 million barrels per day (mbpd) in June, slightly down from the 6.987 mbpd in May, according to data published by the Joint Oil Data Initiative (Jodi). The figure was the lowest since October 2011, the data showed.

The kingdom's production inched up to 9.780 mbpd in June, from 9.705 mbpd in May, Jodi figures showed.

Refiners processed 2.055 mbpd of crude in June, slightly down from the 2.136 mbpd in May, which was the highest since Jodi records began in 2002.

Saudi oil use for power generation surged to 827,000 bpd in June from 680,000 bpd in May and 484,000 bpd in April. June crude burning for power was the highest since March 2013, the data showed.

Oil markets closely monitor changes in Saudi production because it is the only country with spare capacity to significantly alter output according to demand, although surges in Saudi demand over the last few summers have eaten into exports.

Saudi oil use for power surges from February to June as rising temperatures drive up demand for air-conditioning in a country which relies entirely on fossil fuels for power generation and does not have enough gas to satisfy peak power demand.

Saudi Arabia produced 10 mbpd of oil in July, an industry source told Reuters last week. -- Reuters

Kuwait, 1 days ago

The price of Kuwait Export Crude (KEC) fell about $5, from $108.2 per barrel (bbl) at the start of July to $103.4 per bbl at the end of the month, said a report.

The National Bank of Kuwait report noted that the oil prices retreated in July from the nine-month highs reached in June.

The international benchmark crude, Brent, declined $6.9 per bbl from $110 per bbl to $103.2 per bbl, while West Texas Intermediate (WTI) dropped by $6.6 per bbl from $104.5 per bbl to below $98 per bbl—its lowest level in six months.

Underpinning these downward movements was an easing of geopolitical anxieties over Iraq and Libya especially, said the report.

In Iraq, despite the territorial gains made by Islamic State of Iraq and the Levant (ISIS) in the north and northwest of the country, the insurgent advance southwards was eventually held in check by Kurdish Peshmerga forces around Kirkuk and by the Iraqi military based in the vicinity of Baghdad.

The bulk of Iraq’s key oil infrastructure, production and export channels is situated in the south, away from conflict areas.

Meanwhile, in Libya, news that exports were finally resuming in spite of the heavy fighting that was taking place between militias and government units in Tripoli and Benghazi provided some measure of relief for the oil markets.

In the US, the fall in WTI is also reflective of a buildup of crude oil stocks at Cushing, Oklahoma, the main storage hub and pricing point for WTI. This came about as a result of a series of outages at key refineries which have cut refinery runs ahead of the main refinery maintenance period that begins in late August and continues through to October.

The crude oil futures prices similarly declined during the month, influenced by a combination of slower demand, weak refining margins and an easing of concerns about Iraqi and Libyan oil supplies.

ICE Brent futures for December delivery retreated by $4.1 per bbl during the month, closing at $106.9.

For the first time in three years, the price of a Brent futures contract moved higher than the spot price, a price structure known as contango.

World oil demand

The forecast for world oil demand growth during the year has been revised downwards by the International Energy Agency (IEA) by 90,000 barrels per day (bd) to 92.7 million bd.

Compared to last year, global demand is therefore forecast to expand this year 1.2 million bd (1.4 per cent) and global oil demand is projected to expand by 1.4 million bd (1.5) next year to 94.1 million bd, with emerging market economies leading the way. Demand from OECD economies, in contrast, is forecast to decline.

World oil supply

Total crude output (including Iraq) from Organisation of Petroleum Exporting Countries (Opec) in June fell by 186,000 bd compared to the previous month, to 30.6 million bd, according to Opec data obtained through direct communication.

This is despite an increase in output from swing producer Saudi Arabia, which ramped up production by 75,000 bd to about 9.8 million bd in June ahead of the summer peak electricity demand season and in response to extra refinery demand. This is the largest production increase since February and the third consecutive month that Saudi Arabia has increased its output, according to the IEA.

In contrast, Kuwait, Iran and Iraq experienced production declines and non-Opec supplies are projected to increase by 1.4 million bd to 56.3 million bd this year and 1.2 million bd to 57.5 million bd next year, it added. - TradeArabia News Service

Dubai, 1 days ago

Iran has postponed by three months a conference to offer multinationals the rights to develop oil deposits, giving time for sanctions on the country's oil sector to be lifted, a senior official said.

"We want to provide for all the companies to participate and we know they will have difficulties before Nov. 24," Mehdi Hosseini, the head of the Oil Contracts Revision Committee, told Reuters by telephone.

The London conference, previously scheduled for Nov. 3, will take place in late February 2015.

He expressed hope that Iran would reach a comprehensive nuclear deal with the world powers by the deadline.

Iran and six global powers have given themselves until November 24 to reach agreement on Iran's nuclear programme whereby Iran would limit its atomic activities. In exchange, the West would lift sanctions that are hurting Iran's oil-dependent economy.

"American companies have the most problems legally because of the sanctions. We thought it would be better to postpone the conference to provide an opportunity for them and all foreign companies to come back," he said.

Hosseini said Iran's new contract, known as the Iran Petroleum Contract (IPC) would be a longer duration that the previous "buyback" contract. Iran will offer more than 20 new projects, a mix of exploration, green and brown fields, he added.

He declined to say which companies Iran had been in talks with until sanctions had been lifted.

"Our model will provide flexibility and can be fitted depending on the project," he said.

Iran has previously said the new model for oil field development contracts aims to tempt back foreign energy companies with 25-year deals. - Reuters

By Zachary Fagenson

MIAMI Wed Aug 27, 2014 11:21pm BST

Aug 27 (Reuters) - A U.S. congressman urged the Obama administration on Wednesday to block the proposed sale by Venezuela's state oil company of its North American refining unit Citgo, saying it would be against "vital national interests".

Venezuela Oil Minister Rafael Ramirez said earlier this month that the country aims to exit Citgo "as soon as we receive a proposal that serves our interests."

Citgo has three U.S. refineries in Illinois, Louisiana and Texas with combined capacity of some 750,000 barrels per day, and it also has 48 terminals.

Flanked by Venezuelan opposition figures, U.S. Representative Joe Garcia said the proposed sale by Venezuela's socialist-led government was "a huge concern."

The value of Citgo, he said, was derived from the refiner's links to Venezuela's state oil company PDVSA and the OPEC nation's crude oil reserves, which are the biggest in the world.

"It is one of the last assets that the Venezuelans have had and have not been able to damage its value," the Democratic congressman told a news conference in Miami.

"We believe that allowing this government to monetize this part of the Venezuelan patrimony would be a grave mistake."

China displaced the United States as the top destination for Venezuelan oil in 2013, and PDVSA's cash flow has been crimped as much of the oil is used to service loans from Beijing.

PDVSA is working with investment bank Lazard Ltd to sell Citgo, according to people familiar with the situation.

Garcia, whose district includes most of western Miami-Dade County and the Florida Keys, said U.S. companies were owed large amounts of money by Venezuela's government, which nationalized most of its oil industry under the late President Hugo Chavez.

"We don't want a grab bag with a regime that has thus far destroyed everything it's touched," Garcia said.

"I am not about to let them dissipate national assets for one more piñata among thugs. It's just not acceptable. ... The last thing we want them to do is to delink themselves from the U.S. and to not pay its debtors."

Garcia's constituents include many Venezuelan exiles who left home during Chavez's controversial time in office.

Accusing Venezuelan officials of committing abuses in a crackdown on protests against President Nicolas Maduro that began this spring, Washington has barred some government ministers and presidential advisers from entering the United States.

Members of the U.S. Congress, particularly Republicans and Florida lawmakers, have also called for the freezing of U.S. financial assets of Venezuelans considered to be rights abusers. (Reporting by Zachary Fagenson; Writing by Daniel Wallis; Editing by Ken Wills)

US still needs Saudi oil: Embassy spokesman

Kingdom remains most important trading partner after China

A gas flame is seen in the desert near the Khurais oilfield, about 99 miles (160 kilometers) from Riyadh, in Saudi Arabia, on June 23, 2008. (Reuters/Ali Jarekji)

A gas flame is seen in the desert near the Khurais oilfield, about 99 miles (160 kilometers) from Riyadh, in Saudi Arabia, on June 23, 2008. (Reuters/Ali Jarekji)

Riyadh, Asharq Al-Awsat—Saudi oil exports to the US will not be affected by the latter’s recent push to increase domestic oil production, the official spokesman for the US Embassy in Riyadh told Asharq Al-Awsat.

W. Johann Schmonsees denied that the recent boom in the US production of shale oil would affect Saudi oil exports to the US, which he said is hoping to keep its share of Saudi oil exports—currently at 16 percent—unchanged despite recent moves to boost domestic oil production.

Schmonsees maintained that the Kingdom would remain the US’s “main strategic ally” as an oil supplier, pointing out that the Kingdom was currently the second main supplier of oil to the US after Canada.

He said the Kingdom remained one of the US’s most important trading partners—second only to China—with bilateral trade reaching more than 71 billion dollars in 2013, a number the US was looking to increase.

Trade relations between the two countries have been growing at a rate of 17.5 percent since 2011, Schmonsees said, adding that total US foreign direct investment (FDI) to the Kingdom reached 9.7 billion dollars in 2012, and that it has been growing at a 17.5 percent rate since 2011.

Schmonsees also dismissed reports that relations between the two countries had soured in recent years, and maintained that the growing economic ties were an accurate barometer for the state of political relations between the two countries.

HOUSTON, 17 hours, 26 minutes ago

A tanker loaded with $100 million of Kurdish crude oil cannot be delivered in Texas soon because of risks for buyers as Iraq mulls further legal challenges, so a month-long standoff will drag on, a source close to the matter said.

A US court threw out an order to seize the 1 million barrel cargo from the United Kalavrvta tanker in the Gulf of Mexico, after acknowledging it lacked jurisdiction because the ship is beyond US territorial waters, about 60 miles (97 km) offshore.

But the court did not settle the broader dispute between Iraq and the Kurdistan Regional Government (KRG) over who has the sole right to export the crude, a feud Washington has struggled to mediate as it backs a unified Iraq that can resist Islamist militants.

Buyers of Kurdish crude could face lawsuits from Baghdad if the oil moves close to US soil and would also require the seller to provide costly indemnities against potential lawsuits, the source added.

"I think we're going to be in a bit of a standoff for a while," the source said. "Right now they don't really have a way to get the oil onshore."

Despite the court's ruling, cargo handling companies and a would-be buyer balked at bringing the oil ashore.

US refiner LyondellBasell, when asked if it would receive the cargo as planned at its Houston plant, reiterated that: "(We) will not accept delivery of any of the affected crude until the matter is appropriately resolved." Earlier this year, the company received Kurdish crude cargoes.

In another sign of possible delays, not one cargo handling company stepped forward to say it would transfer oil from the United Kalavrvta tanker to smaller ships that can fit into the port of Galveston, the US Coast Guard said.

Axeon Speciality Products earlier this month refused delivery of Kurdish crude at its Paulsboro, New Jersey, refinery.

Baghdad and the KRG have been locked in litigation, both in the United States and Iraq, over who can sell the crude. More legal action is likely after the US judge said Iraq could amend its complaint, a move Iraq is mulling.

The Kurds have claimed the right to sell oil under Iraq's constitution, while Baghdad says it must manage all crude sales.

The Kurds say control over natural resources is crucial for their dreams of independence and because Baghdad has responded weakly to militants who have overrun parts of the country.

Washington has refused to intervene in commercial sales, saying the oil belongs to all Iraqis, while warning companies about the legal risks of dealing directly with Kurdistan.

Despite marketing and legal tangles, Kurdish authorities have continued trying to get their crude to market and loaded additional tankers at the Turkish port of Ceyhan.

One tanker, the United Dynamic, is headed to Ceyhan now. Reuters ship tracking data shows the 1 million barrel Suezmax tanker – managed by the same firm as three other Kurdish tankers would arrive there.

The United Emblem tanker, which has also delivered Kurdish crude, was moored just outside Ceyhan having returned from a delivery in Asia.

So far the Kurds have delivered at least four major cargoes of crude oil carried to Ceyhan on its new pipeline.

Several others have been blocked from delivering. The United Leadership, the first vessel of Kurdish crude to sail from Ceyhan, has been moored off Morocco with a full cargo for more than two months.

The tanker that was turned back in New Jersey, the Minerva Joy, is now headed to Cyprus, an important trading hub. - Reuters

James Bambino, Platts Oil Futures & Options Editor

New York - August 27, 2014

U.S. commercial crude oil stocks fell 2.07 million barrels to 360.48 million barrels during the reporting week ended August 22, U.S. Energy Information Administration (EIA) data showed Wednesday.

The draw found support from still-soaring crude oil runs at U.S. Gulf Coast (USGC) refineries, which continued to set record highs the week ended August 22, hitting 8.75 million b/d. That said, USGC refinery utilization rates -- which include feedstocks other than crude oil -- came off 0.5 percentage point to 96.2% of capacity. This is down from a record 96.9% of capacity the week ended August 15.

At 9.15 million barrels per day (b/d), the USGC is home to more than 50% of the nation's total refinery operable capacity.

As a result of the surge in runs, USGC crude oil stocks fell 2.12 million barrels to 189.1 million barrels, putting them nearly 4.6% above the five-year average of EIA data. Higher imports likely capped the draw, however. USGC imports rose 150,000 b/d to 3.68 million b/d the week ended August 22, but this is still 1.28 million b/d below the five-year average.

The boost was largely a result of a rebound in barrels from Venezuela, which jumped 315,000 b/d to 900,000 b/d the week ended August 22 and could have been related to the reopening of the Louisiana Offshore Oil Port (LOOP), which had been shut for a handful of days during the previous reporting week.

Imports from Saudi Arabia, meanwhile, fell 415,000 b/d to 832,000 b/d. Saudi barrels have vacillated over much of the summer, falling to the mid-800,000 b/d level one week, then rallying above 1.2 million b/d the next week.

U.S. CRUDE OIL PRODUCTION AT NEAR 28-YEAR HIGH

The surge in USGC crude oil runs outpaced a 174,000 b/d increase in U.S. imports -- which rose to 7.63 million b/d -- and a 54,000 b/d rise in U.S. production -- which hit 8.63 million b/d, the highest since the week ended October 31, 1986, when it was 8.77 million b/d.

Total U.S. crude oil runs rose 124,000 b/d to 16.54 million b/d the week ended August 22, although refinery utilization rates stayed largely flat, up 0.1 percentage point to 93.5% of capacity. Analysts surveyed Monday by Platts had been expecting a 0.8 percentage-point decline.

Crude oil stocks at Cushing, Oklahoma -- delivery point for the New York Mercantile Exchange (NYMEX) crude oil futures contract -- rose 508,000 barrels to 20.66 million barrels, largely in line with analysts' expectations.

However, the build runs counter to reports earlier in the week by Genscape, which showed Seaway flows rose by around 65,000 b/d to almost 330,000 b/d, while TransCanada's Gulf Coast Marketlink flows jumped almost 85,000 b/d to more than 256,000 b/d.

Cushing stocks built despite a 101,000 b/d jump in U.S. Midwest crude oil runs, which rose to 3.63 million b/d. Midwest crude oil stocks were largely flat, down 87,000 barrels to 86.42 million barrels.

U.S. ATLANTIC COAST (USAC) GASOLINE STOCKS FALL

U.S. gasoline stocks fell 960,000 barrels to 212.31 million barrels the week ended August 22. Analysts had been expecting a larger, 1.7 million-barrel draw.

Stocks on the USAC -- home to the New York Harbor-delivered NYMEX RBOB contract -- fell 1.09 million barrels to 57.55 million barrels. Despite the drop, USAC inventories remain well-supplied, sitting 3.2% above the five-year average.

Platts cFlow ship-tracking software shows more than 10 clean tankers en route to the region, although it is unclear how many are carrying either gasoline or blending components.

Midwest gasoline stocks, meanwhile, are more than 5.5% below the five-year average after falling 1.01 million barrels to 46.03 million barrels the week ended August 22. Stocks rose 945,000 barrels to 75.2 million barrels on the USGC, which is a key supplier to both the USAC and the Midwest.

U.S. gasoline implied demand* and production were higher the week ended August 22. Demand rose 325,000 b/d to 9.1 million b/d, putting the four-week moving average at 9.04 million b/d, still below year-ago levels.

Production, meanwhile, rebounded 362,000 b/d to 9.51 million b/d. On a four-week moving average, U.S. gasoline production is closer to 9.49 million b/d, 120,000 b/d above year-ago levels.

DISTILLATE STOCKS UP

U.S. distillate stocks rallied 1.25 million barrels to 122.79 million barrels, even as implied demand came off 357,000 b/d to 3.65 million b/d.

The build was largest on the USGC, where stocks rose 2.86 million barrels to 38.93 million barrels. Combined low- and ultra-low-sulfur diesel (ULSD) stocks rose 2.6 million barrels to 33.67 million barrels.

With low and ULSD production steady around 4.72 million b/d, the stock increase could be related to a slowdown in exports. Platts data shows the USGC-Europe diesel arbitrage** narrowed sharply the week ended August 22 despite lower freight rates, making it less attractive to ship diesel eastward.

While EIA weekly export data is just an estimate, the more accurate monthly data for May pegs exports at 1.17 million b/d. June data is set to be released Thursday.

July Demand Down Month over Month; China Becomes Net Exporter of Oil Products

Singapore - August 27, 2014

China's apparent oil demand* in July decreased by 2.1% over the same month a year ago, according to a just-released Platts analysis of Chinese government data.

The apparent oil demand in July was 40.63 million mt or 9.61 million barrels per day (b/d). On a month-over-month basis, this was a 6.2% drop from 10.25 million b/d in June. The fall reversed the positive growth experienced in June.

The contraction occurred because China became a net exporter of oil products in July, with net outflows totaling 450,000 mt, according to data released by the General Administration of Customs on August 8.

In July, China reduced its imports of some oil products, including fuel oil and jet/kerosene; while increasing exports of others, such as gasoil and gasoline. This resulted from a combination of weakening demand - as in the case of gasoil and fuel oil - and higher domestic production for jet/kerosene and gasoline.

Overall, oil product imports during the month slumped 42.8% year-over-year to 1.86 million mt, while exports rose 13.8% to 2.31 million mt.

"The weakness in China's oil demand reflects the ongoing slowdown in its economy," James Bourne, Platts associate editorial director for Asia news. "It is the third time this year that the country has flipped to being a net oil product exporter. This was also seen in March and May, suggesting weakening oil demand."

In July, crude oil throughput by domestic refineries edged up 2% year over year to 9.71 million b/d. However, this represents a 5% slide from the June level of 10.22 million b/d, according to the August 13 data from China's National Bureau of Statistics.

China's apparent oil demand over the first seven months of 2014 edged up just 0.1% to 9.86 million b/d, the slowest pace of growth for the period since Platts started compiling Chinese oil demand data in 2005. In comparison, apparent oil demand expanded by 4% from the January-July period last year.

Gasoline apparent demand rose 8.6% in July from a year earlier to 8.51 million mt. Year-to-date apparent demand for the fuel, used in the booming transport sector, rose 10% year over year.

"Domestic refiners have been raising their yields in favor of gasoline and jet fuel/kerosene and away from gasoil to suit the country's current oil demand profile," said Bourne.

Meanwhile, gasoil again contracted in July due to sluggish industrial activity, with apparent demand declining 2.2% year on year to 14.06 million mt, after growing 4.4% year on year in June. Gasoil demand has been hit by China's economic growth slowdown.

Similarly, apparent demand for fuel oil fell 28% year on year in July to 2.28 million mt, the lowest level since August 2013, as net imports plunged 77% to 260,000 mt.

Consumption of imported fuel oil - widely used as a raw material for the manufacturing of refined petroleum products by small, independent refiners known as "teapot" refineries - has slowed in the last two years as refiners gained greater access to domestic crude oil.

| Jul ‘14 | Jul ‘13 | % Chg | Jun ‘14 | May ‘14 | Apr ‘14 | Mar ‘14 | |

| Net crude imports (million mt) | 23.76 | 26.11 | -9.0 | 23.28 | 26.08 | 27.88 | 23.52 |

| Crude production (million mt) | 17.34 | 17.15 | +1.1 | 17.50 | 17.76 | 16.98 | 17.64 |

| Apparent demand (million mt) | 40.63 | 41.49 | -2.1 | 41.94 | 39.92 | 39.92 | 41.55 |

| Apparent demand (‘000 b/d) | 9,607 | 9,810 | -2.1 | 10,247 | 9,439 | 9,754 | 9,825 |

Sources: China's General Administration of Customs, National Bureau of Statistics, Platts

Month-to-month demand in China is generally viewed to be subject to short-term anomalies which are of interest and important to note, but which often fail to reveal the country's underlying demand trends. Year-to-year comparisons are viewed by the marketplace to be more indicative of the country's energy profile.

*Platts calculates China's apparent or implied oil demand on the basis of crude throughput volumes at the domestic refineries and net oil product imports, as reported by the National Bureau of Statistics and Chinese customs. Platts also takes into account undeclared revisions in NBS historical data.

The government releases data on imports, exports, domestic crude production and refinery throughput data, but does not give official data on the country's actual oil consumption figure and oil stockpiles. Official statistics on oil storage are released intermittently.

Platts releases its monthly calculation of China's apparent demand between the 18th and 26th of every month via press release and via its website. Any use of this information must beappropriately attributed to Platts. Platts uses a conversion rate of 7.33 barrels of crude per metric ton, the widely-accepted benchmark for markets East of Suez.

Aug 27 2014 19:50

Houston - Venezuela's state-run oil company PDVSA is considering importing Algerian light crude to be used as a diluent for its own extra heavy oil, according to an internal company document seen by Reuters on Wednesday, and the move could mark the first ever crude import by the Opec member.

Though Venezuela has the world's largest crude reserves, PDVSA has been buying an increasing volume of refined products such as heavy naphtha in recent years to mix with its crude output from the vast Orinoco belt - its largest producing region.

That is done to make the extra heavy crude exportable as extraction of domestic medium and light crudes, which had been used as diluents, declines.

Naphtha is being imported at high prices paid on the open market and has hurt the cashflow of PDVSA, which is the main source of revenue for the government of President Nicolas Maduro. Crude imports would be less expensive through a supply contract.

"The (PDVSA) commerce department evaluates a strategy of importing Saharan Blend from Algeria," the document says.

The state-run company did not answer requests for comments on possible crude purchases from Algeria.

Venezuela's Petroleum minister, Rafael Ramirez, said earlier this year that PDVSA could import crude as a "last resort" to find diluents for its heavy crudes. But he did not elaborate on the controversial issue.

The South American country has been an oil exporter for almost a century. Last year it sold 2.43 million barrels per day (bpd) of crude and products to foreign clients, according to public PDVSA figures.

The document said PDVSA could use its tankers in its own fleet, including two very large crude carrier (VLCC) tankers that recently entered service, to bring the crude over.

PDVSA has been expanding its tanker fleet to cover longer routes to destinations such as China and India as part of a wider strategy to reduce freight costs.

In July, PDVSA launched a tender to buy at least four 500 000 barrel cargoes of heavy naphtha for September-December and, according to traders, Petrochina and trading firms Delaney and Noble Group were awarded with the offer.

PDVSA was last year in talks with US refining firm Valero Energy to restart five units at the 235 000 bpd Aruba refinery to produce heavy naphtha, but this and other attempts to cut import costs have been unsuccessful.

Venezuela and Algeria have been closely allied within the Opec in recent years, even though they have never entered a joint venture.

Wednesday, 27 August 2014 20:53

imageLONDON: Iraq's oil exports from its southern terminals so far in August have fallen by about 140,000 barrels per day, according to loading data and industry sources, dropping further from a record high reached in May.

Exports from Iraq's southern terminals have averaged 2.3 million barrels per day (bpd), according to shipping data for the first 26 days of August tracked by Reuters. Two industry sources who also monitor the exports had similar estimates.

An advance by Sunni militants who seized swathes of northern Iraq in June has raised concern Iraqi exports could slow down and briefly boosted global oil prices to a nine-month high above $115 a barrel.

But Iraqi oil officials say the southern fields have not been affected by fighting in other parts of the country, and oil industry sources said bad weather had delayed some shipments in August, rather than output disruptions.

"I don't think there is a production issue," said a trader with a company that buys Iraqi crude. "But bad weather does not help."

Exports so far in August are down from July's 2.44 million bpd, but still higher than the 2.22 million bpd scheduled in a preliminary August loading programme. May's average of 2.58 million bpd was the highest since 2003.

Iraq's oil supplies were held back by decades of wars and sanctions. It has been expanding oil production in the south since Western companies signed a series of service contracts with Baghdad in 2010.

Total exports from Iraq's northern and southern ports hit a record 2.8 million bpd in February. But northern exports of Kirkuk crude have been shut since March 2 due to attacks on a pipeline to Turkey, keeping total exports below their potential.

While Kirkuk exports remain off the market, Iraq's Kurdistan region is exporting smaller quantities of oil independently of Baghdad via Turkey's Ceyhan port. Some shipments have been held up under diplomatic and legal pressure from Baghdad.

Copyright Reuters, 2014

ALGIERS, 10 hours, 24 minutes ago

http://www.tradearabia.com/source/2014/08/27/algeria.jpg

Algeria will launch a new five-year investment plan worth $262 billion to boost domestic production and move its economy away from reliance on oil and gas, the government said.

The Opec member north African country has been spending heavily on social programmes and infrastructures to avert unrests and diversify the oil-reliant economy.

But analysts say previous investment plans have had little impact due to a slow pace of reform that has limited foreign and private investors' involvement in bringing the economy out of stagnation.

Projects to be included in the 2015-2019 plan will be finalised before the end of this year, said an official statement following a cabinet meeting chaired by President Abdelaziz Bouteflika late Tuesday.

The new step is intended to "develop a productive and diversified economy", it said, without giving details.

Algeria, a major gas supplier to Europe, depends on oil and gas for about 97 percent of its export earnings and spends over $50 billion per year on goods imports including food and pharmaceutical products.

With $200 billion in reserves, government spending on social programmes, credits and housing helped ease any unrest, but reforms have stalled due mainly to bureaucracy and restrictions on foreign investments despite promises to open up the economy.

The ailing Bouteflika, 77, who is serving a fourth five-year term, had launched a $200 billion investment plan for the 2005-2009 period to build infrastructure including a 1,200-km (750 mile) motorway, water desalination plants and thousands of state-subsidised housing units.

That was followed with a 2010-2014 plan worth $286 billion to complete projects already under way and launch new ones.

But the outcome of those plans was apparently disapponting, and Bouteflika earlier this year ordered the involvement of private businessmen in drafting any new scheme.

"We want to draw lessons, improve its impact on the local and human development, as well as on the development of a productive and competitive economy in all sectors," he said, referring to the 2015-2019 plan. - Reuters

CAIRO, 10 hours, 11 minutes ago

By Ulf Laessing

A comeback by Libya's oil industry may be short-lived as a confrontation between armed groups risks splitting the country three years after the fall of Muammar Gaddafi.

Oil production has risen to 650,000 barrels per day (bpd), five times the level two months ago, in a rare success for the economy at a time when armed groups and two parliaments fight for control of the North African country.

Outgoing Oil Minister Omar Shakmak told Reuters output could rise to 1 million bpd later this year, bringing it close to the 1.4 million bpd Libya pumped until a wave of protests crippled the industry in July 2013.

Such a development would be a crucial boost for Libya's stricken economy, with the central bank forced to use up foreign currency reserves to keep the country running. Yet any targets are subject to factional and tribal conflicts that risk spiraling into civil war.

The recent increase comes after a group of federalist rebels campaigning for regional autonomy implemented a deal to reopen major eastern ports such as Es Sider.

But Libya expert Dirk Vandewalle said federalist rebel leader Ibrahim Jathran might close these ports again, after a rival armed faction from the western city of Misrata took control of the capital Tripoli.

This group has pushed to reinstate Libya's old General National Congress (GNC), refusing to recognize the new House of Representatives. Part of the Misrata forces are backed by the Muslim Brotherhood.

In response, the federalists might opt to exert their power over oil exports and the economy as a whole.

"There is always the possibility that the federalists may take this opportunity to reassert themselves," said Vandewalle, author of the book "History of Modern Libya".

So far, the latest fighting has been away from Libya's oil fields and ports. Yet escalating violence in the eastern city of Benghazi for instance is just 100 km (70 miles) from the Zueitina oil port.

Other disgruntled elements could close pipelines to western fields, cutting off funding to the GNC. Analysts note oil security guards from the same region staged protests before the June elections to block the El Sharara or El Feel fields.

One oil trader said the emergence of two parliaments might also pose legal risks, if the GNC gives orders to the central bank and state oil firm National Oil Corp. The House of Representatives and senior officials have no power in the capital, having left for Tobruk in the east to escape fighting.

"The problems would be if the GNC gives the central bank orders to transfer oil revenues," said the trader. "The legal situation would be unclear to prospective buyers of Libyan oil."

BUDGET DEFICIT

Even if oil exports continue to flow, Libya will still post a historic budget deficit of 70 percent unless output rises to 1.6 million bpd at a price of $100 per barrel, said Husni Bey, who heads one of the of country's largest private conglomerates.

Parliament in June approved a budget worth $49 billion, assuming annual production of 600,000 bpd. But output has lingered around 100,000 bpd.

Libya does not publish oil export figures but needs up to 140,000 bpd of its production for domestic refineries.