Goldman sees LNG as biggest commodity after crude this year

CHOU HUI HONG

NEW YORK (Bloomberg) -- Global trade in LNG will exceed $120 billion this year, taking it past iron ore as the most valuable commodity after oil, Goldman Sachs Group Inc. said.

Competition will increase because the spot market is expanding and buyers are less reliant on long-term contracts, analysts including Jeff Currie in New York wrote in an emailed report on Thursday. The U.S. will supply more LNG in the next several years, giving Asia, the biggest consuming region, more bargaining power, the analysts said.

About 73% of global LNG is sold under long-term contracts generally linked to oil with a time lag of as long as nine months, Most of the rest is sold as spot cargoes in Asia, where prices fell 55% in the past year. LNG trade will grow at an average annual rate of 5.1% from 2014 to 2025 as production starts from the U.S. to Australia and new markets emerge in Asia, the Middle East and the Baltic region, BG Group Plc, which has a fleet of about 25 LNG carriers, said Wednesday.

“As contract and spot prices diverge, oil-indexation will continue to lose its appeal,” Goldman said. “There is a window for LNG to grow and become a normal commodity that is priced according to its own fundamentals rather than those of different, if related, commodities.”

LNG contracts have traditionally been linked to oil prices, such as Brent or the Japan Crude Cocktail that represents various grades the country buys. As oil rises or drops, so does the price of delivered cargoes. By contrast, supplies from the U.S. will be tied to benchmark natural gas prices at Henry Hub in Louisiana.

Spot Prices

Spot prices for LNG delivered to Asia will fall to $6.25 per million British thermal units in the third quarter of 2015, and rise to $7 next year, according to Goldman. They slid 45% in 2014 as benchmark crude prices slumped amid a supply glut in the oil market, and were at $7.60 on March 2, according to data compiled by Bloomberg from New York-based Energy Intelligence Group.

The market will require spot prices to remain at a significant discount to oil-indexed contracts as new projects begin operation, Goldman said in the report.

Planned liquefaction capacity increases in Australia and the U.S. will outpace demand growth of 5% a year and keep global utilization rates below the recent average, even as the long-term outlook remains positive, according to Goldman.

“In order to balance the market, LNG prices will have to decline further post 2016 until they can challenge thermal coal in the fuel mix of the power sector, with Europe playing the role of the swing consumer and the U.S. as the marginal supplier in the Atlantic basin,” the analysts wrote in the report.

Canadian Natural Resources triples profits by pumping more oil

3/5/2015

REBECCA PENTY

CALGARY (Bloomberg) -- Canadian Natural Resources, the nation’s largest heavy crude producer, boosted its dividend by half a cent after reporting an almost tripling of its profit as it pumped more oil to counter the effect of plunging prices.

While other oil producers have cut or eliminated dividends in the wake of falling prices, Canadian Natural boosted its investor payout to 23 Canadian cents a share from 22.5 cents, its 15th straight year of dividend increases. Production rose to the equivalent of 860,920 bopd in the quarter from 677,242 bopd a year earlier.

Canadian Natural is among producers that have scaled back spending after oil prices reached six-year lows in January. The company announced a 28% cut to its 2015 budget in January, part of an estimated $86 billion in budget cuts by the industry globally, according to RBC Dominion Securities.

Canadian Natural said spending for the year would be cut by another C$150 million as it pushed some planned maintenance work into 2016, reducing downtime to six days from 35 days at its Horizon oil-sands project. That quicker turnaround will also increase output by 10,000 bopd, the company said.

ConocoPhillps’ chief economist sees gradual market recovery

By KURT ABRAHAM, EXECUTIVE EDITOR

HOUSTON -- The recovery of the global oil market from sharply lower oil prices will be gradual, and it will be driven mostly by a supply response, said ConocoPhillips Chief Economist Marianne Kah. Her comments came during a presentation to The 5th Norwegian Finance Day, held Wednesday by the Norwegian Consulate General at the Federal Reserve Bank in Houston.

There were a number of drivers that brought about the free-fall of crude prices, said Kah. These include slowing economic growth, particularly in China; a warm start to the North American winter; rising U.S. tight oil production, a temporary return of Libyan oil production; and last, but certainly not least, OPEC’s decision at its November 2014 meeting to not function as a swing producer.

“We’ve had weak global oil fundamentals,” added Kah. “And (in terms of balancing supply with demand), the real question is whether Cushing (Okla.) storage will fill up faster than growth in (U.S.) oil production slows down. Exceptionally cold weather in January and February has helped to increase demand, at least some.”

Kah noted that global oil demand growth over the last half-dozen years has not been as robust as it could have been, due to the fact that “we’ve seen a very moderate global recovery from the 2008-2009 financial crisis. You have to remember that Chinese economic growth and diesel demand growth were the primary drivers of high oil prices in the mid-2000s.”

Another factor playing into the oil price equation, said Kah, is per-capita usage of oil in Western industrialized countries. “There is no doubt that the world is less oil-intensive these days,” she explained. “If the world had the same oil intensity today, that it had in 1985, then we would have oil demand of 135 MMbpd instead of 90 MMbpd.”

Examining the U.S. market specifically, Kah pointed out that U.S. liquids production has returned to levels not seen since 1972, which was the year before the Arab Oil Embargo. “And I think U.S. oil production will continue to grow some yet, despite low prices. You have to look at how productivitiy improvements in the field have improved economics. A lot of R&D learning has gone on in the shales, and it will continue to go on. So, the threshold for economic shale production continues to go lower.”

“Nevertheless, a lot of companies are going to have to stop drilling,” added Kah, “because they simply don’t have the cash. Over the last few years, oil companies, overall, have been investing 120% of cash flow, so they’ve taken on a lot of debt. Thus, activity will go lower. Now, although we will see a dip in activity at $50/bbl, as productivity gains kick in, we’ll eventually see output start to grow again. Another factor to consider is that there will be less infill drilling, which will cause mature areas to decline faster. In addition, industry “cost deflation,” where service companies dramatically lower the prices that they charge, will play a role, too.”

On the natural gas front, “growth in the Marcellus and Utica shales (of the northeastern U.S.) is crowding out most other natural gas production growth,” observed Kah. “The Marcellus has proved to be much more productive than originally thought.” She noted that break-even costs for natural gas production have come down, with the highest levels being about $5/MMbtu, and some plays, like the Rockies and Mid-continent regions, falling to $2.50/MMbtu on the low side.

Internationally, Kah said that European natural gas demand has seen a 20% decline since 2010. This includes a 35% decline in gas usage for power generation, some of which she blamed on policies set by individual European governments, particularly Germany. Kah also warned of an increasing risk of LNG oversupply, due to accelerated development of gas resources in key countries. She said this oversupply would be due first to supplies Australia and later from U.S. sources.

Statoil exec sees a year of cash flow challenges, cost containment

By KURT ABRAHAM, EXECUTIVE EDITOR

HOUSTON -- For the remainder of 2015, the global E&P industry should expect to see operators wrestling with cash flow challenges, negotiating price discounts with suppliers and looking to sell assets to raise cash, said Jason Nye, Statoil’s senior V.P. for U.S. Offshore Development and Production, North America. His comments came during a presentation to The 5th Norwegian Finance Day, held Wednesday by the Norwegian Consulate General at the Federal Reserve Bank in Houston.

“At Statoil, we are managing the cash flow challenge,” said Nye. “This includes examining our portfolio structure and its drivers, reducing CAPEX, driving down costs, selling assets, and practicing balance sheet management—keeping it strong to fund our ongoing business.”

Unfortunately, noted Nye, a number of IOCs and other large producers are having a tough time in the short term. “Total’s breakeven price in 2014, to be revenue-neutral, was $110/bbl,” said Nye. “That’s not going to happen this year. And then, there’s Exxon Mobil, which has a $23-billion funding gap in the U.S. at the moment. Ironically, BP (which is greatly maligned by the media) is the only major with enough cash on-hand to fund all of its operations. So, we look for major IOCs to continue to pursue divestments, to generate cash.”

The cash flow problem, coupled with low commodity prices, is certainly shaping the spending plans of many companies, observed Nye. “Among the peer companies of Statoil, only four—Woodside, Southwestern, Encana and PTTEP—are increasing their budgets. Most companies are reducing their capital spending 25%, which means that about $100 billion, industry-wide, won’t be spent this year. At Statoil, we’re reducing spending 10%, because we have a large, sanctioned program that must continue.”

How the various operators allocate their spending this year will be determined by the indicative breakeven prices for key oil plays, continued Nye. “At the high end of the price scale, the breakeven figure for Canadian oil sands extracted through mining is $100/bbl, and it’s $85/bbl for oil sands produced through SAGD. Arctic plays are at $75, ultra-deepwater areas and U.S. tight oil are at about $70. On the lower end of the scale, onshore Russia is about $50, with heavy oil, in general, at $47, and the U.S. offshore shelf at $41. The lowest is the Middle East, if you can get into any of it, at an average $27/bbl.”

A primary strategy at Statoil this year, continued Nye, is “strengthening our capacity to create long-term value. To that end, our efficiency program is on track, and we’ve stepped it up. We are reducing CAPEX another $2.2 billion, with the U.S. onshore seeming to be the big lever for us—we can ramp it up and step it down, as needed. We’re also maintaining flexibility in our portfolio and adhering to strict capital prioritization. Nevertheless, we’re still growing our production at 2% per year, and later on, we will boost that to 3% per year.”

Nye noted that at Statoil, “we’re focusing on adopting rest-of-world standards and simplifying operations, to get our costs down. In terms of efficiency progress, we have reduced our drilling time per well by 25%; we have cut our U.S. onshore cost, per boe, 30%; we have decreased our facility CAPEX for new projects more than 10%; and we have cut our field costs on the Norwegian Continental Shelf by 20%.”

Genel owed $233m for Iraqi Kurdistan exports

Genel Energy, one of the main oil producers in Iraqi Kurdistan, said it is still owed $233 million for oil it sold to the Kurdistan Regional Government (KRG) but is hopeful stable payments will start this year.

The oil producer reported a full-year loss for 2014 of $312.8 million, mainly due to write-offs relating to some of its exploration assets. Revenues rose nearly 50 per cent to $520 million.

Genel shares were trading 3.5 per cent higher at 0818 GMT.

Oil producers in Iraqi Kurdistan have been caught in the middle of a dispute between the Iraqi central government and the KRG over the rights to valuable oil exports.

The parties struck an agreement at the end of last year and Baghdad has resumed payments to Kurdish officials but money has been slow to trickle through to oil producers.

Genel said the KRG had established a temporary domestic sales channel through which it receives 50 percent of proceeds for oil sales from its Taq Taq field.

"We expect to receive regular payments for exports as we move through 2015," Genel chief executive Tony Hayward said in a statement.

The slump in oil prices has also taken its toll on Genel and it announced in January that it expected lower revenue this year. It has also slashed its capital expenditure programme by 70 per cent from last year to $200-250 million and plans to cut jobs to save costs.

Nuclear deal could be ‘very close’, says Iran

Iran's foreign minister said in a US television interview on Wednesday he believed "we are very close" to a nuclear arms deal with six major world powers, but cautioned there were details that needed to be worked out.

"We are prepared to work round the clock in order to reach an agreement," Mohammad Javad Zarif told NBC News in an interview excerpt released by the network.

"We believe that we are very close, very close and we could be very far," he said. "There are details that need to be worked out.

"We are very close if the political decision can be made to get to yes, as President Obama said," Zarif added.

Zarif and US Secretary of State John Kerry were in a second day of talks in Montreaux, Switzerland on curbing Iran's nuclear program with the aim of securing a framework agreement by the end of March.

The United States and its allies, notably Israel, suspect Iran of using its civil nuclear program as a cover to develop a nuclear weapons capability. Tehran denies the allegation.

In a speech to the US Congress on Tuesday, Israeli Prime Minister Benjamin Netanyahu warned the deal being negotiated was a serious mistake.

Zarif, who has accused Netanyahu of trying to undermine Iran's negotiations toward a nuclear deal, repeated in the NBC interview that Tehran had no intention of building a nuclear weapon.

"Once we reach that understanding, once this hysteria is out, once this fearmongering is out, then we can have a deal, and a deal that is not going to hurt anybody," he said.

Iran's new U.N. ambassador, Gholamali Khoshrou, wrote in an opinion article published on the New York Times' website on Wednesday that the Israeli leader appeared to be afraid that the nuclear negotiations between Tehran, the United States, Britain, France, Germany, Russia and China will succeed.

"Mr. Netanyahu seems to be in a state of panic at the prospect of losing this tool with which to attack Iran, as we do all in our power to address the genuine concerns of the international community and arrive at a settlement over our country's nuclear energy program," wrote Khoshrou.

The six powers and Iran have an end-June deadline to reach an agreement that curbs sensitive Iranian nuclear work in exchange for sanctions relief. The Western powers hope to have a political framework agreement by the end of March. – Reuters

Oil prices predicted to steady in 2015, says hedge fund survey

Fri, 06/03/2015 - 06:00

Members of the New York Hedge Fund Roundtable, a non-profit industry organisation committed to promoting ethics and best practices in the alternative investment industry, believe oil prices will remain steady for the rest of 2015.

Questions about oil and energy were posed to members at the Roundtable’s February event, “Global Implications of the Current Energy Environment.”

More than a third of members polled stated that the price of a barrel of crude oil would be in the USD50 - USD60 range by the end of 2015; approximately 22% of members forecast that the per barrel price would be USD40 - USD50; and 21% said that the price would settle between USD60 - USD70 a barrel. Less than 1% of those surveyed suggested the price would end the year below USD30 per barrel, while 7% said the price would rise to more than USD70.

When asked what type of energy companies provided the best investment opportunities in 2015, 30% said renewable energy companies were the most attractive and 29% pointed to independent oil & gas companies as strong investments. Pipelines followed with 15%, closely followed by large oil and gas companies at 14%. A total of 10% of members polled by the New York Hedge Fund Roundtable said that oil field services and offshore drillers presented the best investment opportunities this year.

Asked about the future of OPEC, 12% of members polled thought OPEC would cease to exist in 10 years, 78% said the organisation would be less powerful than it is today and 8% forecast that OPEC would be more powerful than it is today.

Roundtable members polled about oil consumption largely agreed that China would be the world’s largest consumer of oil in 10 years, with 63% selecting the country. India was second in the poll with 24%, the U.S. was third at 12% and Russia garnered less than 1% of the vote in the poll.

The survey was conducted at the February Roundtable event, which featured Tom Kirkwood, Partner, Bakken Energy Fund, Ken Locklin, Director, Impax Asset Management and Bloomberg Energy Analyst, Andrew Cosgrove.

Oil edges higher as ECB measures boost market sentiment

Published: Mar 6, 2015 1:29 a.m. ET

By ERIC YEP

Crude-oil futures rose in Asian trade Friday in line with positive sentiment in wider financial markets after the European Central Bank raised its growth forecasts and said it would begin its bond buying program from Monday.

On the New York Mercantile Exchange, light, sweet crude futures for delivery in April CLJ5, +0.24% traded at $50.95 a barrel, up $0.19 in the Globex electronic session. April Brent crude LCOJ5, +0.53% on London’s ICE Futures exchange rose $0.38 to $60.86 a barrel.

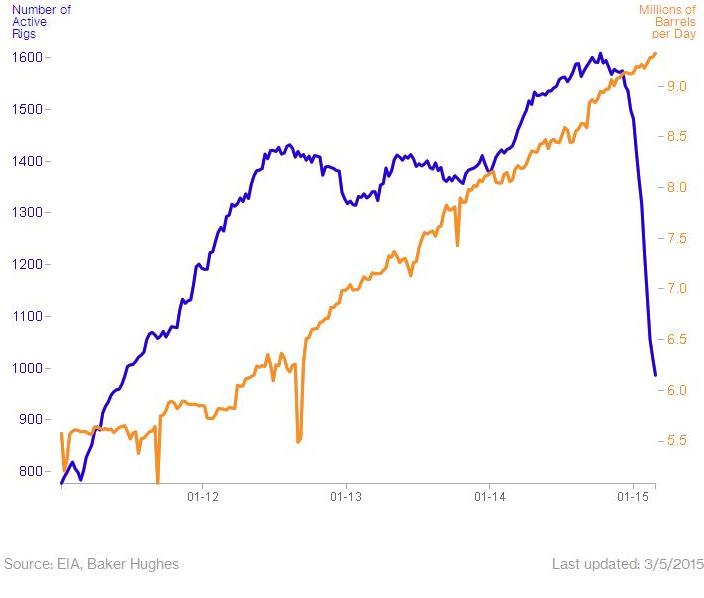

Oil market investors will also be looking out for the weekly U.S. rig count data and the U.S. non-farm payrolls report later today.

Investors have been interpreting U.S. drilling rig numbers, published by oilfield services company Baker Hughes, as an indicator of future U.S. oil production levels.

“Despite record declines in the rig count, [oil] production continued to reach record levels which exacerbated volatility,” Mark Keenan, Societe Generale’s head of commodities research in Asia, said in a report.

He said declining rig count data and general market nervousness have triggered a surge in investment flows into exchange traded products in the last few weeks, which is indicative of speculative buying.

Additionally, Brent and WTI crude were also the two commodities most sensitive to market risk, caused by macroeconomic, currency and interest rate fluctuations, in the past month, Mr. Keenan added.

Libya on the radar: Ongoing supply outages in Libya and U.S.-Iran nuclear talks are also being closely tracked.

The immediate impact of Libya’s force majeure on its oil production will be limited as most output was already offline, but damage to infrastructure and reservoirs is of greater concern as it undermines a recovery, BMI Research, a unit of Fitch Group, said.

U.S. stocks edged higher, snapping a two-session losing streak, as investors focused on Europe’s stimulus measures and looked ahead to the U.S. jobs report.

“The growing involvement of radical jihadist groups in the Libyan conflict will lead to a wider targeting of oil and gas infrastructure in 2015,” BMI said in a report.

Meanwhile, Saudi Arabia’s foreign minister said that Gulf Arab countries support international talks over Iran’s nuclear program, but remain concerned about Tehran’s regional influence. The U.S. is currently in talks with Iran to curb Tehran’s nuclear ambitions.

Nymex reformulated gasoline blendstock for April RBJ5, +0.60% — the benchmark gasoline contract — rose 151 points to $1.9024 a gallon, while April diesel traded at $1.8871, 98 points higher.

ICE gasoil for March changed hands at $580.75 a metric ton, down $0.25 from Thursday’s settlement.

The Price of Oil Is Down, So Why Is Production Still Going Up?

America's oil paradox explained

Too much oil, too fast.

That turns out to be the downside of the U.S. oil boom—at least if you’re an investor. Prices crashed, and America is pumping so much crude its running out of places to store it. One promising sign you may have heard about: The plunge in U.S. oil rigs.

Every week since 1944, oilfield-services company Baker Hughes has released a survey of rigs out drilling for oil. But it wasn't until oil prices dropped by more than half that "rig counts" became part of everyday business vocabulary. Oil watchers are desperate for any sign of an end to the glut.

Drillers have been shutting down rigs at a record pace. But oil production isn’t slowing yet. In fact, the U.S. is pumping more crude now than at any time in 40 years. Why? We explore the conundrum in our animated explainer: Why Cheap Oil Doesn't Stop the Drilling.

Exxon Looks to U.S. Shale Fields to Drive Global Growth

by Joe Carroll

March 5, 2015

Exxon Mobil Corp. Chief Executive Officer Rex Tillerson said, North American shale “is more resilient than some people think it is.” Photographer: Andrey Rudakov/Bloomberg

(Bloomberg) -- In a world of $55 a barrel oil, Exxon Mobil Corp. is relying on shale fields in Texas, Oklahoma and North Dakota to help fund the next wave of big overseas projects it needs to thrive in the future.

Exxon unveiled plans Wednesday to double the amount of oil it pumps from U.S. shale fields during the next three years, even as it moves more cautiously on investments in big projects elsewhere. Decades after quitting many U.S. fields to pursue bigger reserves from the Middle East to the North Sea, Exxon now sees its U.S. assets as its most reliable cash engines.

With its leading technology, expertise and market clout, the biggest U.S. oil producer has been able to reduce costs and improve efficiency in domestic shale fields it began acquiring in 2010. That progress, coming even as the price of crude has dropped, has allowed Exxon to generate “attractive returns,” said Chief Executive Officer Rex Tillerson.

“It might surprise some people how attractive some of these things are in this environment,” Tillerson told a gathering of investors in New York Wednesday. North American shale “is more resilient than some people think it is.”

Exxon expects its worldwide production of crude and natural gas to climb 7.5 percent to the equivalent of 4.3 million barrels a day by the end of 2017, the Irving, Texas-based company said. The last time Exxon performed at that level was 2011.

America Rising

The U.S. contribution to Exxon supplies has been nudging higher for the last few years amid Tillerson’s renewed focus on domestic assets in shale and other so-called tight rock resources that require intensive drilling and fracturing techniques.

U.S. wells accounted for 22 percent of Exxon’s crude output last year, up from 15 percent in 2008. The supply bump from Exxon’s domestic, onshore fields during the next three years will be driven by drilling in West Texas, North Dakota and southern Oklahoma, according to the company.

A “significant portion” of U.S. shale fields are competitive with overseas oil projects at current prices, Tillerson said, thanks to more efficient production techniques and cost cutting. His statement contradicts many analysts who had predicted most shale wells would become money losers as crude fell below $75 a barrel.

Tillerson’s remarks on Wednesday “suggested to us that an opportunistic acquisition is increasingly likely, particularly if low prices persist into 2016,” a team of analysts led by Paul Sankey at Wolfe Research LLC said in a note to clients.

“Our assumption is that the top target for a deal would include U.S. unconventional, led by the big three plays where they already have scale and learning: Bakken, Permian and Woodford/Ardmore,” the Wolfe team wrote.

Shale Operators

The “key potential targets” with strong positions in those regions include Hess Corp., Continental Resources Inc., Apache Corp., Devon Energy Corp. and Anadarko Petroleum Corp., Sankey’s team wrote.

EOG Resources Inc. and Occidental Petroleum Corp. would also be good candidates, though they may be too expensive, the Wolfe analysts said. Pioneer Natural Resources Co. and Denbury Resources Inc. may also attract Exxon’s attention, they wrote.

The solid returns offered by U.S. shale gives Exxon more flexibility to defer investment in bigger projects until market conditions improve, Tillerson said. A nine-month rout in global crude prices is spurring oil companies to postpone or cancel exploration projects to conserve cash.

For Exxon, a fresh injection of shale oil couldn’t come at a better time: the company’s fourth-quarter output fell to the lowest for that period since it acquired Mobil Corp. in 1999. And its exploration failure rate worsened to 39 percent in 2014 from 33 percent a year earlier.

Sanctions Hit

Exxon has about $1 billion tied up in a Russian joint venture with Rosneft OAO that’s been left in suspended animation after U.S. and European Union sanctions forbade investment in that nation’s Arctic, shale and deep-sea oil sectors. Russia surpassed the U.S. to become Exxon’s biggest exploratory prospect last year.

Exxon is sticking to production targets established when oil traded for more than $100 a barrel, signaling confidence that demand for crude-based fuels will continue to expand.

The company plans to increase output by 2 percent this year and 3 percent annually in 2016 and 2017, according to a presentation that accompanied Tillerson’s remarks. The outlook assumes an average crude price of $55 a barrel.

Little Changed

The forecast is little changed from Exxon’s outlook a year ago. At the time, Brent crude, the benchmark for international oil sales, traded for about $108 a barrel. The price has since fallen about 44 percent as global supplies grew faster than consumption, an imbalance Tillerson suggested may not change any time soon.

“There’s a lot of supply out there and I don’t see a particularly healthy economy,” Tillerson said. “My opinion is, people have to kind of settle in for a while, and I can’t tell you how long that’s going to be.”

Crude output from U.S. shale fields probably won’t decline much, if at all, in response to tumbling oil prices, said Tillerson, who entered his 10th year as CEO in January. Politically volatile regions such as Libya and Iraq will add to the global glut as conditions improve, putting additional pressure on prices, he said.

Production growth will be driven by oil and so-called gas liquids such as propane, which will increase by 7 percent this year and 4 percent annually in 2016 and 2017, according to the presentation. Natural gas output will drop 2 percent annually this year and next before rising 4 percent in 2017, according to the presentation.

Exxon fell 0.5 percent to $86.74 at the close in New York. The shares are down 7.5 percent in the past year.

America's oil-savings spending boom is coming

The Financialist

Ashley Kindergan, The Financialist

Americans drive more than motorists anywhere else in the world, according to the World Bank. When the average price of a gallon of gasoline dropped from $3.70 to just above $2 — a 45 percent drop — in seven months, economists predicted American households would put their unexpected $150 billion windfall to use in shopping malls, restaurants, and online.

The hoped-for spending boom has yet to truly materialize – stuck in traffic? – but it’s still on the way.

U.S. consumer spending increased 4.3 percent in the fourth quarter – the biggest quarterly jump since 2006. But that included a slight decline (0.3 percent) in December, despite the fact that personal income also rose by 0.3 percent that month. Meanwhile, retail sales excluding automobiles and gasoline were completely flat in December and inched up just 0.2 percent in January.

But the larger economic backdrop is getting steadily more supportive of an increase in consumer spending. Job growth, as evidenced in non-farm payroll data, is faster than at any time since 1999. At the same time, consumer credit is expanding rapidly. The 6.9 percent increase in 2014 is the fastest annual growth rate since 2001. And while consumer confidence dipped in February, it’s still running at pre-crisis levels.

Then there’s the fact that the savings from cheap oil – and presumably, the wealth effect from those savings – haven’t fully materialized, largely due to seasonal factors. Consumers spent $8 billion percent less on energy on an annual basis in December, but savings aren’t expected to peak until March at $16 billion.

Gasoline usage gradually increases as the weather warms and doesn’t peak until August. The real savings, in other words, will start to hit home when Americans who have been hunkered down for winter start venturing out again. But it’s also true that good news simply takes time to sink in. “On average, it takes 6 months of declining gasoline prices for the consumer to believe that it’s here to stay and feel comfortable enough to spend,” says Barbara Reinhard, Chief Investment Officer in the Americas for Credit Suisse’s Private Banking and Wealth Management Division. “So we think that you are about to see a strong trajectory for consumer spending in the US, and globally as a result of the decline in commodity prices.”

A second catalyst for a consumer spending uptick has nothing to do with gasoline. Consumers crank up their thermostats the most in January and February, which in many cases means racking up big heating oil bills. The Northeast uses 81 percent of the nation’s heating oil, and February temperatures have shattered record lows from Washington, D.C. to snow-inundated Boston.

But this year, despite the bitter cold, the Energy Information Administration forecasts that Americans who warm their homes with heating oil will spend 30 percent less ($1,645) than they did last year, thanks to lower prices. Those who use propane can expect to spend 23 percent less in the Northeast and 35 percent in the Midwest.

While total spending on energy decreased just $1.6 billion in the Northeast in December, EIA forecasts suggest those savings will surge to $2 billion in February and up again, to $3 billion, in March. Retailers with large customer bases in the Northeast, including DSW (27 percent of stores) TJ Maxx (26 percent), Dick’s Sporting Goods (26 percent), Burlington Coat Factory (23 percent), and Macy’s (23 percent), may see a benefit from consumers having more money in their pockets, according to Credit Suisse. For retailers and other consumer-focused businesses, March may well come in like a lion and out like a lamb.

The Financialist is a digital magazine presented by Credit Suisse that looks at the trends and ideas that drive markets, businesses and economies.

This article originally appeared at The Financialist. Copyright 2015. Follow The Financialist on Twitter.

US oil edges above $51, on track for weekly gain

SLucy Nicholson | Reuters

U.S. crude nudged up to hover around $51 a barrel on Friday, set to post the first weekly gain in three, as geopolitical tensions in the Middle East supported oil.

U.S. crude rose 26 cents to $51.02 a barrel by 0006 GMT, on track for a more than 2 percent gain this week.

Brent settled down 7 cents at $60.48 a barrel on Thursday, on track for its biggest weekly drop in two months.

Libya's warring factions held United Nations-backed talks on Thursday after deteriorating security forced the OPEC state to declare force majeure and halt production at 11 oilfields late on Wednesday.

Islamic State militants have set fire to oil wells northeast of the city of Tikrit to obstruct an assault by Shi'ite militiamen and Iraqi soldiers trying to drive them from the Sunni Muslim city and surrounding towns, a witness said.

Brent's premium to U.S. crude settled at $9.66 on Thursday, widening from $8.80 in the previous session.

Iran's foreign minister on Thursday suggested that a 10-year moratorium on some aspects of the country's nuclear program might be acceptable to Tehran, though he declined to discuss the issue in detail.

Billions of dollars are pouring into oil exchange-traded funds as investors, many of them small savers more familiar with stocks than commodities, risk big losses and focus on the chance of huge rewards.

Iraq, Iran and Libya are wildcards for oil: Expert

Matthew J. Belvedere| @Matt_Belvedere

SHARESDespite the meltdown in the oil market, prices are more likely to rise than to fall further because of geopolitical instability, an industry consultant told CNBC on Thursday.

"Iraq, Iran, [and] Libya, history tells us that those don't get solved very quickly or very easily. I don't see downward pressure from them coming back on online. I probably see more upward pressure from disruptions going on in that area," Carl Larry, director of oil and gas business development at Frost & Sullivan, said on "Squawk Box".

Larry's comments were in contrast to what Exxon Mobil CEO Rex Tillerson told CNBC in a separate interview that aired Thursday.

Tillerson said more oil supply could come to the already bloated crude market if things were to calm down in hot spots like Libya or Iraq.

Read MoreExpect more volatility in oil: Exxon CEO

As for U.S. production, Larry predicted, "Oil production in America [will] stay where it's at. We won't see that exponential growth that we've seen over the past few years."

But Tillerson said the crude market has been surprised by how robust American production has been year after year. "There's another million-plus barrels coming out of North America."

Brent oil hovers under $61, WTI falls

REUTERS

LONDON: Brent crude futures pared early gains on Thursday to hover just under $61 as the euro slipped to an 11-year low against the dollar, offsetting concerns about tensions in Iraq and Libya.

The euro fell against the dollar, making commodities priced in greenback more expensive for holders of other currencies, after European Central Bank chief Mario Draghi left the door open for asset purchases beyond September 2016.

Brent crude front-month futures were trading 34 cents higher at $60.89 a barrel by 1438 GMT while West Texas Intermediate (WTI) crude CLc1 fell 38 cents to $51.15.

Brent has traded around $60 since mid-February, rebounding from a six-year low of about $45 hit in January.

Brent and WTI rose earlier on Thursday due to concerns about oil supplies from Libya and Iraq. A deteriorating security situation led Libya’s state oil company to declare force majeure on 11 of its oilfields on Wednesday.

Output from Libya was at more than 400,000 barrels per day on March 1, higher than in January but well below the 1.6 million bpd levels seen before the country’s 2011 civil war.

In Iraq, militants set fire to oil wells in the Ajil field east of Tikrit to try to hinder aerial attacks aimed at driving them from the oilfield, a witness and military source said.

“The market does seem to be paying a little bit of attention to geopolitical factors, namely Iraq and Libya,” said Virendra Chauhan, oil analyst at Energy Aspects.

Government data showed commercial crude stockpiles in the United States hit a record high last week, rising twice as much as expected to 10.3 million barrels, but that failed to keep prices down.

In the US, jobless claims unexpectedly rose to 320,000 for the week ended Feb. 28.

Tehran’s ambassador to the International Atomic Energy Agency (IAEA) said on Wednesday no deal had been reached on the duration of any possible final agreement with world powers on Iran’s program. That allayed investors’ fears of an imminent rise in Iranian oil supply.

“The rate of stock build has accelerated week by week throughout February and with upcoming refinery maintenance likely to weaken demand for crude, it is possible that this will continue in March,” BNP Paribas analysts said in a note.

US crude settles down 77 cents, at $50.76 a barrel

U.S. crude futures ended lower on Thursday after a volatile trading session in the face of a strong dollar and the U.S. commitment to forge a nuclear deal with Iran.

Concerns about deteriorating oil supplies from Libya and Iraq boosted crude prices even before the New York session.

Without new bullish factors apparent in U.S. trading hours, the market stayed afloat on buying from those convinced it had hit bottom since the June-January selloff that had knocked 60 percent off crude prices, analysts said.

U.S. crude for April delivery closed 77 cents, or 1.5 percent, at $50.76 a barrel after hitting a session peak of $52.40.

The front-month contract in benchmark Brent crude was flat at $60.60 a barrel, after rallying more than $1 earlier.

"The fundamentals dictate that prices should be lower, but market bulls and bottom pickers continue to discount bearish news and embrace anything that's even remotely bullish," said Dominick Chirichella, senior partner at the Energy Management Institute in New York.

A deteriorating security situation led Libya's state oil company to declare force majeure on 11 of its oilfields on Wednesday. Output from Libya is at about a quarter of highs seen before the country's 2011 civil war.

In Iraq, Islamic State militants set fire to oil wells in the Ajil field east of Tikrit to try to hinder aerial attacks aimed at driving them from the oilfield.

Those bullish factors ran contrary to the spike in the dollar and the U.S. decision to press ahead with its nuclear negotiations with Tehran.

The dollar jumped to 11½ year lows against the euro after European Central Bank chief Mario Draghi left the door open for asset purchases beyond September 2016. A stronger dollar is regarded a negative for oil as it weakens demand for crude from buyers holding other currencies.

U.S. Secretary of State John Kerry said a nuclear deal with Tehran would address security concerns of Gulf Arab countries, although Washington was not seeking a "grand bargain" with Iran, a reference to wider political and security cooperation.

On Monday, oil tumbled, with Brent falling 5 percent, on fear that a quick nuclear deal for Tehran could lift U.S. and other Western government sanctions against the OPEC nation and flood the market with new oil exports.

Weaker-than-expected U.S. jobless claims and factory orders and a drop in nonfarm productivity were other negatives for oil.

Oil Investors Face Biggest Hurdle in 5 Years: Chart of the Day

by Moming Zhou

(Bloomberg) -- Investors in the biggest exchange-traded fund that tracks crude oil prices are facing their most serious challenge in five years.

The CHART OF THE DAY shows U.S. benchmark oil futures for delivery in the second month are trading near the biggest premium to first-month contracts since 2010. That will penalize holders of the U.S. Oil Fund, which is scheduled to start selling the cheaper expiring contracts and buying the more expensive ones on Friday.

This month’s rollover of contracts comes as investors are holding the most number of shares in the ETF, shown in the lower panel, since 2009 as they bet on a rebound in oil prices from the lowest level in almost six years. The premium in second-month contracts started in November and is already having an effect. While WTI advanced 3.2 percent in February, the U.S. Oil Fund lagged behind with a 1.6 percent gain.

“The roll losses are clearly hurting oil ETFs,” said Michael Hiley, head of over-the-counter energy trading at LPS Partners Inc. in New York. “They may erode the enthusiasm for these products.”

U.S. Oil Fund gained 2.8 percent to $19.01 Wednesday on the New York Stock Exchange. WTI for May delivery rose 1.4 percent to $53.23 a barrel on the New York Mercantile Exchange, 3.3 percent higher than the April contract. The premium jumped to 4.8 percent on Feb. 27, the highest since May 2010, when WTI declined 14 percent and the U.S. Oil Fund slid 18 percent.

The number of outstanding shares in the ETF reached 141.9 million Tuesday, the highest since 2009. On that day it held 52,160 contracts of April WTI futures, equivalent to 52.2 million barrels of oil, according to the fund, which has total assets worth $2.64 billion.

The current contango may cost investors 3 percent to 4 percent over the next month, but it’s not the only factor to consider, said John Hyland, chief investment officer of U.S. Commodity Futures Funds, the Alameda, California-based manager of the U.S. Oil Fund.

Congress Facing Huge Pressure To Lift Oil Export Ban

By Nick Cunningham

A lobbying blitz is underway to scrap the decades old ban on crude oil exports from the United States.

Originally implemented during price spikes in the 1970’s, oil exports from the U.S. have been legally blocked, save for exemptions given to exports to Canada. That was largely a nonissue for several decades as the U.S. was a massive importer of oil, and there wasn’t much of an opportunity for domestic drillers to export crude.

That all changed in the last few years with a flood of new production. Calls for lifting the ban on exports began in earnest in 2014. The Obama administration has not decisively taken a stance on the issue, but has shown some willingness to allow exports to move forward. In June 2014, the Commerce Department granted waivers to a several producers to export ultralight forms of oil known as condensate. Rather than satiate demands for export, the move only sparked more interest.

Many more companies applied for their own waivers, and Commerce began approving them. In December 2014 the agency also issued a clarification on what constitutes “condensate,” and while it did not issue a blanket lift on the oil export ban, the move essentially green lighted the export of ultralight forms of oil that had undergone only minimal processing.

The Obama administration threw the industry a bone by offering a relief valve for all the oil supplies that have built up within U.S. borders. By allowing some exports, the federal government opens up the market for producers, where they can sell oil at a higher price. After all, WTI is currently selling for just $50 per barrel, while Brent is selling at a $10 premium.

But now the oil industry, sensing its advantage, is stepping up the lobbying effort to once and for all scrap the four decade export ban.

More than 80 companies that are members of the Independent Petroleum Association of America (IPAA) flooded Capitol Hill this week to lobby for an end to the oil export ban. “Those members, who have flown in this week from several states including Colorado, Illinois, Louisiana, Ohio, and Texas, have 150-plus meetings scheduled with House and Senate offices to urge lifting the U.S. crude oil export ban,” Politico reported.

On the same day, the U.S. Chamber of Commerce hosted the CEO of ConocoPhillips in Washington DC, across the street from the White House. He called for an end to the export ban, citing production and inventory build ups that could overwhelm the nation’s refining ability. “We shouldn’t put U.S. producers at a competitive disadvantage by limiting access to global markets,” CEO Ryan Lance said.

Lifting the ban on exports is still controversial, even among some Republicans. The head of the Senate Energy and Natural Resources Committee Lisa Murkowski (R-AK) has called for liberalizing oil exports, and plans to hold a hearing on the matter on March 19. However, her counterpart in the House, Fred Upton, has shown some hesitation. Upton says getting rid of the ban “will only happen after an open review of the current policy,” citing the debate on LNG exports that took more than a year.

The industry has already succeeded in kick starting that debate, and with low prices, oil companies are going on the offensive, and appear to be gaining momentum within Congress and the administration to rip up the 40-year ban on exports.

By Nick Cunningham of Oilprice.com

Lower oil prices will stay a while: CEOs

Exxon Mobil chief executive Rex Tillerson expects the price of oil to remain low over the next two years because of ample global supplies and relatively weak economic growth.

"People kinda need to settle in for a while," Tillerson said at the company's annual investor conference in New York.

In a presentation to investors outlining its business plans through 2017, Exxon assumes a price of $US55 a barrel for global crude. That's about half of what Brent averaged between 2011 and the middle of 2014.

The price of oil plunged in the second half of 2014 when it became apparent that production was outpacing global demand. US production was particularly robust, with the increase of 1.5 million barrels per day being the third largest on record, according to a report from BP. Meanwhile, weakening economic conditions in China, Japan and Europe slowed the growth in oil demand.

BP chief executive Bob Dudley made remarks similar to Tillerson's in a recent call with investors. The CEOs' comments reflect an increasingly common industry view that new sources of oil around the globe, relatively slow growth in demand, and large amounts of crude in storage will keep a lid on prices for the foreseeable future.

"When you have that much storage out there, it takes a long time to work that off," Dudley said.

The US Energy Department has reported that US oil supplies have grown to 444.4 million barrels, the highest level at least 80 years.

Tillerson cautioned that geopolitical turmoil could unexpectedly send prices higher. But, he said, that if tensions calm, much more oil is ready to hit the market.

Production in Libya has been erratic in recent years because of political upheaval there. Production in Iran, once OPEC's second largest exporter, has been depressed in recent years because of Western sanctions. Those sanctions could be eased if current talks over Iran's nuclear program make progress.

"I see a lot of supply out there," Tillerson said.

@YahooNZBusiness on Twitter, become a fan on Facebook

Crude Oil Ends Lower On Strong Dollar

3/5/2015 3:05 PM ET

U.S. crude oil ended lower on Thursday, as the dollar strengthened against a basket of select currencies with investors apprehensive on the supply glut after an official weekly oil report yesterday showed crude stockpiles to have jumped much more than expected last week.

Nonetheless, investor were also concerned over deteriorating oil shipments from Libya and Iraq, even as the talks with Iran seem to be progressing toward a nuclear deal.

Investors discounted the Saudi Arabian oil minister's take on demand Wednesday as mere rhetoric, with demand remaining soft and supplies continuing to be high. With refineries shutting down for maintenance, crude stockpiles in the United States hit a record high, rising 10.3 million barrels last week.

Oil prices were also impacted after some disappointing economic data from the U.S., even as China lowered its growth target for 2015.

In a somewhat troubling sign for the labor market ahead of tomorrow's monthly jobs data, a Labor Department report on Thursday showed an unexpected increase in first-time claims for U.S. unemployment benefits in the week ended February 28. The claims rose to their highest level since the week ending May 17, 2014.

New orders for U.S. manufactured goods unexpectedly declined in January due mainly to a drop in non-durable goods orders that offset a rebound in durable goods orders, a Commerce Department report showed Thursday.

Meanwhile, China lowered its growth target for 2015 to 7 percent amid a challenging global environment and stressed the importance of reforms to build a moderately prosperous society, at its annual session of the National People's Congress in Beijing on Thursday.

Light Sweet Crude Oil futures for April delivery, the most actively traded contract, dropped $0.77 or 1.5 percent to settle at $50.76 a barrel on the New York Mercantile Exchange Thursday.

Crude prices for April delivery scaled a high of $52.40 a barrel intraday and a low of $50.61.

On Wednesday, crude oil rose $1.01 or 2.0 percent to settle at $51.53 a barrel, even as the official weekly oil report from the Energy Information Administration showed crude stockpiles to have jumped much more than expected last week, with inventories at its highest in about 80 years.

U.S. crude oil inventories surged 10.3 million barrels in the week ended February 27, while analysts expected an increase of 3.7 million barrels. The report showed total U.S. crude oil inventories at 444.7 million barrels.

The dollar index, which tracks the U.S. unit against six major currencies, traded at 96.44 on Thursday, up from its previous close of 95.91 on Wednesday in late North American trade. The dollar scaled a high of 96.59 intraday and a low of 95.84. The dollar touched its highest intraday in the last one year.

The euro trended lower against the dollar at $1.1022 on Thursday, as compared to its previous close of $1.1081 on Wednesday in late North American trade. The euro scaled a high of $1.1116 intraday and a low of $1.0990, its lowest in the last one year.

On the economic front, new orders for U.S. manufactured goods unexpectedly declined in January due mainly to a drop in non-durable goods orders that offset a rebound in durable goods orders, a report from the Commerce Department showed Thursday.

The report said factory orders edged down by 0.2 percent in January after tumbling by 3.5 percent in December. The modest drop surprised economists, who had expected orders to inch up by 0.2 percent.

U.S. labor productivity in the fourth quarter fell more than initially reported with output rising less than previously estimated, a Labor Department report said Thursday. The productivity for the fourth quarter dropped by a revised 2.2 percent compared to the previously reported 1.8 percent decrease. Economists expected productivity to fall by a revised 2.3 percent.

A Labor Department report on Thursday showed an unexpected increase in first-time claims for U.S. unemployment benefits in the week ended February 28. Initial jobless claims edged up to 320,000, an increase of 7,000 from the previous week's unrevised level of 313,000. Economists expected claims to drop to 295,000.

The European Central Bank will commence its bond purchases under an historic $1.1 trillion quantitative easing plan next week and expects the impact from it stimulus measures to return inflation to the euro area next year.

ECB President Mario Draghi said Thursday that the bank will start purchasing public sector bonds in the secondary market on March 9, under the QE scheme announced in January. Mario Draghi said the central bank will not buy bonds with yields lower than its deposit rate of negative 0.2 percent.

Earlier in the day, the ECB left interest rates unchanged for a fifth consecutive session after its meeting in Nicosia, Cyprus.

Meanwhile, the Bank of England also kept its key rate unchanged at a historic low of 0.50 percent. The central bank has persisted with the low rate at every policy meeting since March 2009, when the rate was cut to confront recession at the peak of the financial crisis.

From Asia, China lowered its growth target for 2015 amid a challenging global environment and stressed the importance of reforms to build a moderately prosperous society, at its annual session of the National People's Congress in Beijing on Thursday. Premier Li Keqiang said the government aims to achieve about 7 percent economic growth in 2015.

In 2014, the government had targeted about 7.5 percent growth, and achieved 7.4 percent, which was the weakest expansion since 1990.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Where Oil Prices Go From Here

By Mohamed A. El-Erian

Last summer, after an unusually long period of relative stability, oil prices embarked on a downward journey, decreasing by half in just six months.

In the last few weeks, however, the market has worked on establishing a floor, enabling prices to regain some of the lost ground. Even so, they are unlikely to return to $100 a barrel soon, and the consequences of the plunge have yet to play out fully.

Oil Prices

The reasons for the sharply lower oil prices include increased supply from both traditional and non-traditional sources, such as shale; lower demand, particularly from high-intensity users such as China; and a change in the willingness of the Organization of Petroleum Exporting Countries, and Saudi Arabia in particular, to continue to play the role of swing producer (lowering production in response to declining prices, which in the past provided an earlier and broader floor for the market).

The shock to oil prices reflected what economists would characterize as unusually unfavorable movements both on and among supply and demand curves. These developments in combination caught many off guard. Now, however, the sharply lower oil prices are inducing enormous supply destruction that has yet to run its course: The price drop has rendered many existing oil fields uncompetitive, curtailed alternative energy sources and stalled longer-term expansion investments.

While this supply destruction buttresses oil prices in the short- and medium-term, there are three strong reasons it will probably prove insufficient to lift prices back to the level that prevailed in the first half of last year any time soon.

First, significant demand creation appears to be materializing more slowly than expected. Part of the reason is specific to the energy market, including consumer uncertainty about the durability of lower oil prices, and the costs involved in altering energy consumption patterns. Another contributor has to do with general hesitation to take economic risk, as opposed to financial risk, particularly for companies that might consider expansion and capital investments.

Second, lower prices have created economic, financial and political pressures on some oil-producing countries -- Nigeria, Russia and Venezuela -- that, under certain conditions, could entail future disruptions in their supply to the global energy market. The impact has been to accentuate concerns about instability in countries such as Iraq and Libya.

Third, Saudi Arabia reaffirmed this week its November decision not to play the role of swing producer, and the oil minister added that this approach would be proven correct. More specifically, this time, the output reduction will be borne less by OPEC and more by higher-cost non-OPEC producers. As such, OPEC -- and Saudi Arabia in particular -- won't need years to re-establish some of the lost market share.

Assuming there is no major geopolitical shock, there are three implications for oil prices for 2015. First, expect continued consolidation, though volatile at times, with a tendency toward higher oil prices over the course of the year. Second, there will be no quick return to the $100 level. Third, low-cost producers of oil and traditional energy products will expand their market share.

To contact the author on this story:

Mohamed El-Erian at melerian@bloomberg.net

To contact the editor on this story:

Max Berley at mberley@bloomberg.net

Platts Analysis of U.S. EIA Data

U.S. crude oil stocks soared 10.4 million barrels last week

Platts Oil Futures Editor Geoffrey Craig

New York - March 04, 2015

U.S. commercial crude oil stocks jumped 10.4 million barrels during the week ended February 27, according to U.S. Energy Information Administration (EIA) data released Wednesday.

Analysts surveyed by Platts on Monday had expected crude oil stocks to increase 3.7 million barrels week over week.

Stocks at Cushing, Oklahoma -- delivery point for the New York Mercantile Exchange (NYMEX) futures contract -- increased only 540,000 barrels.

Cushing stocks have built continuously since the week ended December 5, more than doubling to 49.2 million barrels. However, the smallest increase during this time period -- 540,000 barrels -- occurred during the week ended February 27.

By region, the largest build occurred on the U.S. Gulf Coast (USGC), where stocks rose 5.4 million barrels to 219.873 million barrels. U.S. Midwest (USMW) stocks rose 3.3 million barrels to 133.3 million barrels.

U.S. refineries processed less crude oil the week ended February 27, contributing to the inventory accumulation. Crude oil runs fell 130,000 barrels per day (b/d) to 15.1 million b/d.

The refinery utilization rate dipped 0.8 percentage point to 86.6% of operable capacity, matching analysts' expectations.

In the same reporting period one year ago, the utilization rate was 87.4%, while the average in the same week from 2010 through 2014 was 83.2% of operable capacity.

Crude oil imports rose 89,000 b/d to 7.4 million b/d, another factor behind the weekly build.

Imports from Canada decreased 244,000 b/d to 2.9 million b/d. Imports from Saudi Arabia fell 216,000 b/d to 745,000 b/d.

Despite a slowdown in oil drilling activity, crude oil production continues to rise, increasing 39,000 b/d to 9.3 million b/d the week ended February 27. One year ago, output was 8.1 million b/d.

"In essence, refiners currently cannot fully utilize crude production, given the many refineries that are configured to run on imported, sour, heavy crudes," BNP Paribas analysts said in a note Wednesday. "And in the absence of lifting the U.S. crude export ban, stocks have inevitably built."

Crude oil stocks could continue building in March as demand falls amid the refinery maintenance season, the bank analysts said.

CUSHING DYNAMICS

At 49.2 million barrels, Cushing's inventory has reached about 69% of its working storage capacity, according to EIA figures.

The rapid rate in which Cushing has filled during the last six months has raised the possibility the hub will reach its physical limits this spring.

Traders have wanted to store barrels at Cushing because they can make money buying crude oil and selling NYMEX futures for later-dated delivery.

In February, second-month NYMEX futures averaged $1.09 per barrel (/b) more than front-month delivery futures. That premium increased sharply in late February, reaching a monthly high of $2.38/b February 27.

"The signal being sent to the market is that storage is running out and to stop sending barrels to Cushing," Energy Aspects said in a note this week, referring to the April-May West Texas Intermediate (WTI) contango* widening beyond $2/b.

Meanwhile, storage appears more plentiful on the USGC, where storage tanks were 56% full as of February 20, EIA said Wednesday in a Today in Energy story.

The "key protagonist" behind the build at Cushing was Enbridge's Flanagan South Pipeline, Energy Aspects said. The Flanagan South Pipeline runs from Illinois to Oklahoma, and was intended to allow crude oil from Canada to flow to Texas along a contiguous route, they said.

Cushing was seen initially as a pass-through point connecting Flanagan South to Seaway Twin, but its role changed as shippers used a re-entry clause included in the tariff rules, allowing them to store barrels in Cushing for up to six months, the consultancy said.

Another factor possibly luring more barrels away from Cushing into the USGC has been stronger USGC crude oil differentials, analysts say.

Mars was assessed Tuesday at a $3.10/b premium to WTI, up from a 75 cents/b discount February 2, Platts data show.

DISTILLATE STOCKS FALL

U.S. distillate stocks fell 1.7 million barrels the week ended February 27, EIA data showed, compared with the 2.2 million-barrel decline analysts expected.

At 123 million barrels, distillate stocks were 10.3% below the EIA five-year average for the same reporting period.

The drawdown was largest on the U.S. Atlantic Coast (USAC) as cold weather drove up demand. Combined stocks of low- and ultra-low-sulfur diesel fell 3.2 million barrels to 22.8 million barrels.

At 22.8 million barrels, the region's inventory swung from a 6.5% surplus to 8% deficit to the EIA five-year average.

USMW combined stocks decreased 397,000 barrels to 32 million barrels, a 3.9% surplus to the five-year average.

USGC combined stocks were 37.8 million barrels, up 903,000 barrels and 2.1% above the five-year average.

U.S. gasoline stocks increased 46,000 barrels to 240.06 million barrels the week ended February 27. Analysts had expected a 1.7 million-barrel drawdown.

On the USAC -- home to the New York Harbor-delivered NYMEX futures contract -- gasoline stocks decreased 2 million barrels, mitigating the build.

At 67.6 million barrels, USAC gasoline stocks were 10.5% above the five-year average.

USMW gasoline stocks rose 700,000 barrels to 54.3 million barrels, a 2.1% deficit to the five-year average. USGC gasoline stocks increased 1.1 million barrels to 79.1 million barrels, a 5.1% surplus to the five-year average.

* Contango is the industry vernacular for the condition whereby prices for nearby delivery are lower than prices for future-month delivery.