Brent crude has been the global benchmark against which most oil is measured ever since the field from which it draws its name was discovered in the 1970s.

The first Brent futures were introduced in 1988 as a way for traders and refineries to smooth out volatile price movements and stabilise the market, which was being increasingly dictated by Middle East producers and the world’s largest consumers in the US.

Initially, the contract only comprised light-sweet crude oil from the Brent field in the North Sea, but then was broadened to include a blend of high-quality oil from 15 different areas in the province. Today, the contract comprises oil from just four fields: Brent, Forties, Oseberg and Ekofisk.

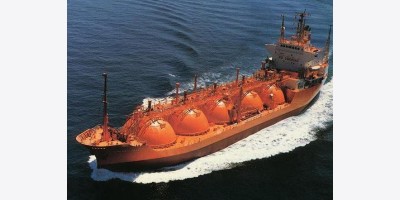

Despite declining production in the British side of the North Sea and the start of decommissioning part of the Brent field itself, the contract is still used as a reference against which about two-thirds of the world’s oil is priced. The high quality of the oil makes it ideal for refining into high-grade diesel, petrol and other petroleum products. Because it is largely delivered by ship, it can also be easily distributed anywhere in the world. Although it accounts for only about 1m barrels per day (bpd) of physical supply, compared with world demand of around 92m bpd, Brent crude remains the Dom Pérignon of tradable oil.

However, its role as the preferred global benchmark is soon to be challenged by a new contract that is expected to be offered to the market next month. China is thought to be plotting the downfall of Brent and its US cousin, West Texas Intermediate (WTI), as the world’s second largest economy seeks to gain more control over the pricing of its main source of energy. The Chinese are expected to launch their own global crude contract as early as next month. Unlike Brent and WTI, the new contract will be priced in China’s yuan instead of US dollars.

To be traded on the Shanghai International Energy Exchange to compete with the existing global benchmarks, traders are already talking about the new benchmark potentially superseding these more established crude futures contracts.

The launch of the Chinese contract is also a reflection of Beijing’s growing influence over world energy and commodities markets. China has now grown to be the world’s second largest consumer of oil after the US and is quickly closing the gap as more of its gigantic population aspire to the trappings of a middle-class lifestyle such as a family car. Oil companies such as Royal Dutch Shell have plans to open hundreds of new filling stations in China to meet expected demand from the country’s burgeoning transport sector.

Developing a futures contract is the logical next step for China now that it has developed into a major power in the physical market for crude oil. Competition among the world’s largest producers in the Organisation of the Petroleum Exporting Countries (Opec) such as Saudi Arabia and Iraq are competing fiercely to win a greater share of a market they see being the future of the industry.

The Chinese government has already laid the groundwork for this transition to happen by partly liberalising the market by allowing independent refineries in the country access for the first time to oil imports. Opening up China’s downstream refining industry has also added to pressure on state oil companies which should lay the foundations for a yuan-based oil contract to gain traction in the local market.

This will add to pressure on Brent and London to maintain their role as a pivot for global oil futures. As European countries continue to pursue policies that are intended to reduce the importance of hydrocarbons in the real economy, the physical market upon which futures depend is being gradually undone.

Although it’s too early to predict the end of Brent futures, or the role of the dollar in oil trading, China’s new crude contract signals a wider shift towards Asia.